Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

With the Wealthsimple Cash Card, you can make purchases and access cash without the need for a traditional bank account or credit score.

Curious to know more? This article dives into all the details of the Wealthsimple Cash Card, helping you determine if it’s the right fit for your financial needs.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

Outline:

· The Wealthsimple Cash Card Explained

· Understanding How It Works: Wealthsimple Cash Card

· How to Obtain a Wealthsimple Cash Card

· Qualifications for Obtaining a Wealthsimple Cash Card

· Is it Possible to Retrieve Money from your Wealthsimple Card?

· Is the Wealthsimple Cash Card Accepted for Online Purchases?

· What Charges Come with the Wealthsimple Cash Card?

· Advantages and Disadvantages of the Wealthsimple Cash Card

· What sets Wealthsimple Cash Card, KOHO Mastercard, and EQ Bank Card apart?

· Is the Wealthsimple Cash Card Secure?

· Frequently Asked Questions (FAQs)

· Conclusion

Wealthsimple Cash Card

- Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

- With the Wealthsimple Cash Card, you can make purchases and access cash without the need for a traditional bank account or credit score.

- Curious to know more? This article dives into all the details of the Wealthsimple Cash Card, helping you determine if it’s the right fit for your financial needs.

The Wealthsimple Cash Card Explained

The Wealthsimple Cash Card is designed for simplicity and ease of use, this card takes the hassle out of tracking and managing your finances.

The Wealthsimple Cash Card is designed for simplicity and ease of use, this card takes the hassle out of tracking and managing your finances.

Offered by Wealthsimple Payments Inc. in collaboration with Mastercard and People’s Trust Company, the Wealthsimple Cash Card, also known as Wealthsimple Mastercard, combines convenience and savings like never before.

Unlike traditional banks, the Wealthsimple Cash Card doesn’t burden you with monthly maintenance, annual, or foreign exchange fees. Plus, you can even earn cashback on your purchases.

With the Wealthsimple Cash Card, receiving and making payments is as simple as a swipe or a tap. No more waiting around for transactions to clear.

Understanding How It Works: Wealthsimple Cash Card

With a simple sign-up process and easy activation through our user-friendly app, you can start using this card right away.

With a simple sign-up process and easy activation through our user-friendly app, you can start using this card right away.

You can shop with confidence, as the card is accepted wherever Mastercard is recognized.

But what sets the Wealthsimple Cash Card apart is its innovative feature of automatically sorting your expenses into categories like groceries, transportation, and dining.

This powerful tool allows you to effortlessly track your spending and identify areas where you can make smarter financial choices.

The Wealthsimple Cash Card for everyday expenses can add up over time because it offers 1% cash back on all purchases, which may sound small but is still a significant benefit.

Keep in mind that the Wealthsimple Cash Card is connected to your Wealthsimple Cash account, which works as a combination of a checking and savings account. So, your card can only be used for purchases up to the amount of funds available in your Wealthsimple Cash account.

Wealthsimple Cash Card has unique features and benefits that make it a convenient and user-friendly debit card. However, depending on your financial needs and goals, it may not be the best option for everyone.

How to Obtain a Wealthsimple Cash Card

Obtaining a Wealthsimple cash card is a fast and simple process. Follow these steps:

1. Create a Wealthsimple account

To get your cash card, you need to create an account with Wealthsimple. By doing this, you can access their investing services and other features.

2. Obtain the cash card:

To get a cash card from Wealthsimple, you need to sign up for an account. Once you have signed in, go to the “Cash” section and select “Apply for Cash Card.” Then, simply follow the instructions given.

3. Cnfirm your identity:

To prevent theft or other malicious activities, You are required to provide some of your personal information to proceed with the card processing.

4. Await Your Card Arrival:

When your application has been approved, you will receive your card by mail within 10-14 days. Once you receive it, activate it immediately so that you can start using it.

Qualifications for Obtaining a Wealthsimple Cash Card

To be eligible for the Wealthsimple Cash Card, you must meet certain requirements. Please note the following eligibility criteria:

· To create a non-registered account, you need to provide the required forms of identification.

· In order to proceed, you need a valid Social Insurance Number (SIN).

· To be eligible, you need to reside in Canada and be a resident of Canada.

· To open an investment account, you need to meet the age requirement set by your province.

Is it Possible to Retrieve Money from your Wealthsimple Card?

ATM that accepts Mastercard will allow you to withdraw cash using your Wealthsimple Cash Card. However, keep in mind that withdrawing cash may incur ATM fees. It’s recommended to check with your bank concerning their fees.

I also want you to note that the daily limit for ATM withdrawals with the Wealthsimple Cash Card is $500 CAD.

In general, even though the Wealthsimple Cash Card is not a regular bank account, it provides the convenience of being able to withdraw cash when necessary.

Wealthsimple Cash Card

- Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

- With the Wealthsimple Cash Card, you can make purchases and access cash without the need for a traditional bank account or credit score.

- Curious to know more? This article dives into all the details of the Wealthsimple Cash Card, helping you determine if it’s the right fit for your financial needs.

Is the Wealthsimple Cash Card Accepted for Online Purchases?

You can definitely use the Wealthsimple Cash Card for online transactions. It is a Mastercard debit card that can be used at all locations where Mastercard is accepted.

Like any other debit or credit card from other financial institutions, you can use it to make online purchases.

The product is available as both a virtual card and a physical card. The virtual card is handy for making purchases online.

The Wealthsimple app allows you to monitor your expenses in real time when you use the Wealthsimple Cash Card for online transactions, making it highly convenient.

You will also have the ability to view the amount you are spending on different purchases and make changes to your budget if needed.

In addition to that, you will receive a 1% cash back on all transactions made with the card, which can accumulate over time.

Also keep in mind that the Wealthsimple Cash Card does not offer fraud protection for online purchases, unlike certain credit cards.

It is important to ensure the security of your card information and only use it on reputable websites. If you see any unauthorized charges on your card, promptly notify Wealthsimple.

What Charges Come with the Wealthsimple Cash Card?

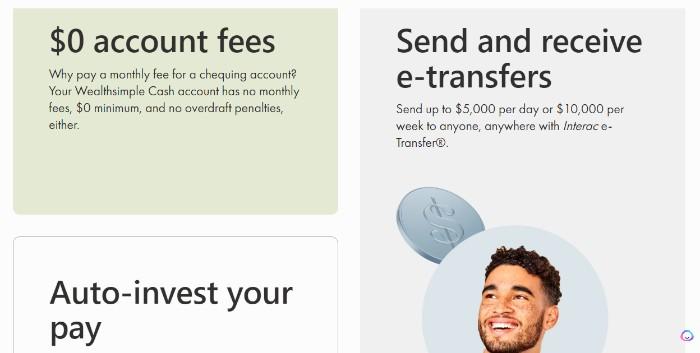

One entrancing part of this is all about the fee-free life! That’s right, no monthly fees, no foreign exchange charges, and no pesky ATM fees. You no longer need those pricey traditional banks!

With the Wealthsimple Cash Card, no minimum balance requirements too. No need to stress about keeping a specific amount in your account just to avoid fees.

And the real deal is – while the Wealthsimple card itself won’t charge you a dime, you might encounter the standard ATM fee of around $3.00 when you make a withdrawal.

If you want to avoid excessive fees and charges from traditional banking services, then the Wealthsimple Cash Card is a great option.

Advantages and Disadvantages of the Wealthsimple Cash Card

After discussing its functionality and other important features, let’s now explore the advantages and disadvantages of the Wealthsimple Cash Card.

Advantages

1. Handle Finances with Ease

The Wealthsimple app provides budgeting tools, financial health overview, and transaction monitoring features for individuals who use the Wealthsimple Cash Card for managing their finances and paying bills.

2. Favorable Currency Rates

You can use your Wealthsimple Cash Card to make purchases at stores that accept Mastercard when you are traveling outside of Canada.

3. Cashback Guaranteed

Anytime you use your Wealthsimple Cash Card to make a purchase, you will earn 1% cashback. Though it may seem like a small amount, over time it can accumulate into a significant sum if you use the card frequently for your routine purchases.

4. No Recurring Charges:

Wealthsimple Cash Card is unique compared to traditional banks because it doesn’t charge any monthly fees. In other words, you won’t have to spend more money every month to maintain your account.

5. No-Fee Cash Withdrawals

With a Wealthsimple Cash Card, you can withdraw money from any ATM in Canada without incurring additional fees from Wealthsimple. However, you may still be subject to the standard ATM withdrawal fee charged by the ATM itself.

Disadvantage

1. Exclusive metal card

If you were looking forward to getting a Wealthsimple cash card made of tungsten, you might not be able to receive one as it is only available to certain people.

2. Inability to build a credit Rating

The Wealthsimple cash card won’t affect your credit score as it works like other cards that don’t contribute to building your credit. Therefore, if you solely rely on Wealthsimple for your credit check, your score will probably remain unchanged.

3. No insufficient funds coverage:

If there are insufficient funds in your account, you won’t be able to make purchases using the Wealthsimple Cash Card as it doesn’t provide overdraft protection.

4. Limited supply

To be eligible for the Wealthsimple Cash Card, you must be of the minimum age required by your province and located in Canada.

Wealthsimple Cash Card

- Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

- With the Wealthsimple Cash Card, you can make purchases and access cash without the need for a traditional bank account or credit score.

- Curious to know more? This article dives into all the details of the Wealthsimple Cash Card, helping you determine if it’s the right fit for your financial needs.

What sets apart Wealthsimple Cash Card, KOHO Mastercard, and EQ Bank Card?

Let’s first provide an introduction to KOHO Mastercard and EQ Bank Card before discussing their differences.

KOHO Prepaid Mastercard

KOHO prepaid Mastercard is a card that can be reloaded and has no annual fee. Additionally, it provides a free budgeting app to assist you in managing your finances.

KOHO prepaid Mastercard is a card that can be reloaded and has no annual fee. Additionally, it provides a free budgeting app to assist you in managing your finances.

The KOHO card offers a welcome bonus of a $20 cashback promo code, no minimum income requirement, and zero interest rate. Additionally, it provides rewards of up to 5% cash back on debit purchases.

KOHO Card is available for free. However, you have the option to upgrade to the KOHO Premium card for additional features. Please note that some fees may apply for the premium version.

EQ Bank Card

EQ Bank Card is a prepaid card that does not have any yearly fees, monthly account fees, or foreign exchange fees. Additionally, it offers 2.50% interest on the balance and allows for free ATM withdrawals all across Canada.

EQ Bank Card is a prepaid card that does not have any yearly fees, monthly account fees, or foreign exchange fees. Additionally, it offers 2.50% interest on the balance and allows for free ATM withdrawals all across Canada.

Wealthsimple Cash Card offers a high-interest rate for savings and provides 0.50% cash back on all purchases. The table below compares the Wealthsimple Cash Card with the KOHO Prepaid Mastercard and EQ Bank Card.

Source– Savynewcanadians.com

Is the Wealthsimple Cash Card Secure?

The safety of financial tools is always a concern, but you can be assured that the Wealthsimple Cash Card is very secure.

The card is issued by a reputable company called People’s Trust Company, which is a financial organization based in British Columbia, Canada. This company is also responsible for issuing other prepaid cards such as Mogo and KOHO.

Your money is managed by CWB using the Wealthsimple Card, and CWB is a member of the Canada Deposit Insurance Company (CDIC), ensuring that your cash deposits are secure and insured up to $100,000 in case CWB faces bankruptcy.

Frequently Asked Questions (FAQs)

Is the Wealthsimple Cash Card made of metal?

The Wealthsimple Cash Cards are typically made of plastic. However, a few select users may have access to a metal version, which is not as widely available as the plastic version.

How to utilize the Wealthsimple Cash Card

The Wealthsimple cash card can be used in different ways. It may be used wherever MasterCard is accepted, including paying for purchases using the virtual cash card.

If you don’t have a Wealthsimple Cash account yet, you can sign up online and receive a welcome bonus. You can use the virtual cash card right after signing up while waiting for the physical card to be delivered.

Is there a sign-up bonus offered by Wealthsimple Cash?

Definitely, When you sign up for a new Wealthsimple account and fund it, you will receive a cash bonus ranging from $5 to $3000.

Will using the Wealthsimple Cash Card impact your credit score?

Wealthsimple Cash Card does not have an impact on your credit score, unlike a standard prepaid card.

Wealthsimple Cash Card

- Looking for a simple and secure solution to handle your finances? Then I bet the Wealthsimple Cash Card is there for you- the top choice in Canada.

- With the Wealthsimple Cash Card, you can make purchases and access cash without the need for a traditional bank account or credit score.

- Curious to know more? This article dives into all the details of the Wealthsimple Cash Card, helping you determine if it’s the right fit for your financial needs.

Conclusion

The Wealthsimple Cash Card is a great choice if you’re seeking a prepaid card with excellent cashback rewards, no annual fees, and exceptional customer service. By using this card, you can earn up to 1% cashback on all purchases and enjoy free ATM withdrawals throughout Canada.

I would recommend this card to anyone looking for an easy way to manage their finances without worrying about high-interest rates or hidden fees. One of its benefits is that it won’t affect your credit score, unlike other cards. Its features, convenience, and affordability make it a great choice.