In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

In this post, we will delve into the world of metal credit cards, highlighting the key aspects that make them truly remarkable. These outlines may want to bother you but we are here to solve these issues

· Are you eligible for a metal credit card in Canada?

· Want to know the best metal credit cards available in Canada?

· What exactly is a metal credit card?

· Wondering which companies offer metal credit cards in Canada?

· Need to know how to properly dispose of a metal credit card in Canada?

· Curious about how to obtain a metal credit card in Canada?

We are here to assist you in these various aspects.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

My Definition of a Metal Credit Card?

A metal credit card is a special kind of credit card that is crafted from durable materials such as stainless steel or titanium. Unlike typical plastic credit cards, metal credit cards are much more resistant to damage.

They still function in the same way as regular credit cards, with the ability to charge interest on unpaid balances, set credit limits, and even provide rewards points and insurance coverage.

However, the most notable distinction of metal credit cards lies in their luxurious and weighty appearance. These cards have a nice, fancy look outside. They make your money activities look special.

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

Qualification for Metal Credit Cards Canada

To get a metal credit card in Canada, you have to meet certain requirements. And here are some of them:

1. You must attain the legal age accepted by your province or territory.

2. To be eligible, you must have a minimum credit score of 660.

3. Lastly, your annual income must be approximately $150,000 as an individual or $200,000 as a household (specific requirements may vary among different metal card issuers)

4. You need to be a legal resident that’s in Canada with a profound credit history.

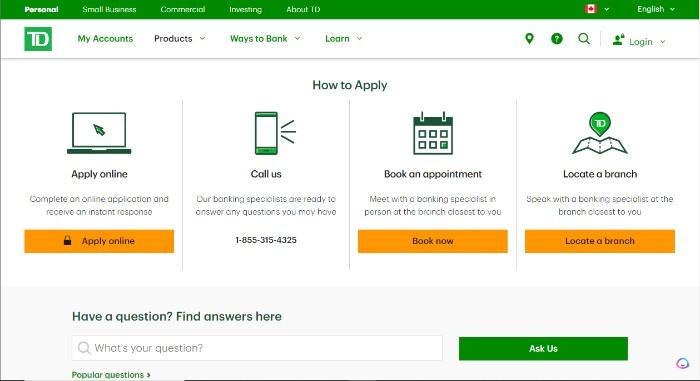

What are the steps to obtain a metal credit card in Canada?

The process of obtaining a metal credit card in Canada varies depending on the insurer or provider you choose. Generally, however, the following steps should help you get started:

#1: Look Into Various Card Options

To obtain a metal credit card, you should begin by researching various card options and comparing their fees, features, rewards, and interest rates.

#2: Know if you meet the qualification of a metal card

Different insurers and providers have varying eligibility criteria. Once you have chosen your preferred option, the next step is to carefully assess if you meet their eligibility requirements and if your credit score qualifies.

#3: Finalize Your Application Process

Apply for your insurance online or in person if you meet the insurer’s standards. Once you’ve finished your application, simply wait for approval. Upon approval, your card will be issued to you.

Which Canadian companies provide metal credit cards?

Source out for the security and peace of mind that comes with obtaining a metal credit card from a reputable financial institution in Canada.

By choosing a well-established provider, you can mitigate potential risks compared to acquiring one from a third-party provider.

While both options have specific criteria to meet, it’s worth considering renowned institutions such as the following when seeking a metal credit card in Canada:

· American Express

· Canadian Imperial Bank of Commerce (CIBC)

· HSBC

· TD Bank

· Bank of Montreal (BMO)

Discover 7 Best Metal Credit Card Canada

Here are the top-notch metal credit cards in Canada that you can easily obtain with a simple application. Unlike some other metal credit cards in Canada that may demand an invitation or a special client status, we’ve got you covered with today’s featured cards.

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

1. TD® Aeroplan® Visa Infinite Privilege Card

· The credit card charges 19.99% interest for purchases and 22.99% interest for cash withdrawals.

· The credit card charges 19.99% interest for purchases and 22.99% interest for cash withdrawals.

· For every dollar you spend, you have the potential to earn up to two Aeroplan points.

· If you want to get a card for someone else, it will cost you $199.

· The annual cost is $599, which you are required to pay.

· Extensive travel insurance covers a lot of things like doctor visits, lost luggage, and canceled flights while you are away from home.

·The cost of insuring your mobile device is $1500.

· To obtain these exclusive benefits, either you alone must have a minimum income of $150,000 per year or your combined family income must be at least $200,000 per year.

· Rocky Mountaineer, Avis Rent-A-Car, and Budget Rent-A-Car have special offers. You can get discounts if you use these services.

· There are certain exclusive lounges called Maple Leaf and Dragonpass lounges that you are allowed to enter.

· There is a rewards program at Starbucks that allows you to earn points for rewards. Similarly, Uber offers exclusive discounts to its members.

· Applying for a NEXUS card can give you up to $100 back.

· Priority boarding entitles you to board the plane before others. Baggage handling refers to the service of taking care of your bags. Airport upgrades include better amenities such as improved food or faster service during your time at the airport.

You can get the most out of your credit card with the TD® Aeroplan® Visa Infinite Privilege Card. This powerful card not only offers rewards and travel insurance but also comes with a wide range of exciting benefits.

You can also enjoy the convenience of free access to six airport lounges every year, giving you a luxurious and comfortable space to relax before your flight.

Plus, take advantage of special airport services such as baggage assistance, priority boarding, and even upgrades.

But that’s not all – when you use your TD® Aeroplan® Visa Infinite Privilege Card to book through the Visa Infinite Luxury Hotel Collection, you’ll receive seven exclusive benefits that will elevate your hotel experience.

There are over 900 hotels worldwide in this collection. This card provides travel medical insurance coverage of up to $5 million for the first 31 days of your trip. However, for spouses over 65 years old, the coverage is limited to the first 4 days of the trip.

Furthermore, the card provides these:

· Misplaced and Pending bagged insurance

· Flight and Journey delay insurance

· Carrier Travel Accident Insurance

· Trip Abortion and Hindrance

Disadvantage

· Residents of Quebec are not eligible for this card offer.

· The yearly fee is expensive.

2. BMO Eclipse Visa Infinite Privilege* Card

· There are insurance policies available that can protect your travels, mobile phones, and purchases.

· There are insurance policies available that can protect your travels, mobile phones, and purchases.

· The annual cost of this is $499 every year.

· You can receive special treatment like anyone assisting you with various tasks

· Certain places offer special benefits such as discounts on hotels or free rounds of golf, known as hotel and golfing perks.

· For every dollar you spend, you can receive up to five times the points.

· To clarify, if you are an individual, you must earn a minimum annual salary of $150,000. If you have a family, your minimum annual salary would need to be $200,000.

· The Visa Airport Companion provides you with 6 free airport lounge visits per year.

· With a Priority Visa airport companion membership, you can enjoy exclusive benefits while traveling through the airport including effortless parking and assistance with your luggage.

· By adding another person to your card, you will receive an additional 25% more points.

· You can receive $200 every year to use towards your travels.

· The interest rate for purchases is 20.99%, while the interest rate for cash advances is 23.99%.

The BMO Eclipse Visa Infinite Privilege Card is a rewards card in Canada that offers additional benefits for purchases made with it.

This credit card is designed for adults who enjoy indulging in leisure activities. Each year, you will receive a $200 credit that can be used for any purchase you desire. Additionally, you will earn an extra 25% in reward points every time you make a purchase.

With this card, every dollar you spend on groceries, drugstore items, travel, gas, and dining earns you a whopping 5 times the rewards points. For all other purchases, you still get 1 reward point per dollar. Plus, you can use your card to treat yourself to a mobile device worth up to $1,000.

You are entitled to visit an airport lounge for free 6 times every year which has a value of over $250!

Disadvantage

The earning rates will not accelerate beyond $100,000 of spending.

3. Business Platinum Card from American Express·

Yearly Pay: $499

· Newbie Tip: 90,000 points

· Interest rates: vary

The American Express Business Platinum Card offers small businesses and cardholders a substantial welcome bonus and exclusive travel perks. You can also redeem your cashback rewards.

Managing your money is easy as a card member. You can spend without limits and get 55 days without interest. With that, you have the flexibility to choose your preferred payment method.

The Business Platinum Card from American Express offers exclusive rewards and insurance coverage for business travel.

The American Express Business Platinum Card stands out from other credit cards because it offers bonus points for referring others. Across a year, you could earn a total of 225,000 points!

And for me, that’s quite entrancing because I won’t overthink it!

With the points you have accumulated, you can exchange them for various rewards including food, gift cards, household items, show or movie tickets, and even travel packages.

As a card member, you have access to 1300 airport lounges located worldwide. This includes both Plaza Premium Lounges and the Centurion® Lounge network, enhancing your travel experience.

International airlines offer special discounted prices for booking trips, which are lower than the regular prices. These discounted prices are also available to your friends and family.

Disadvantage

· They don’t have an introductory earn rate to use rewards efficiently

· Not all suppliers or businesses will take American Express cards. This could make it harder for your business to do things.

· High annual fee

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

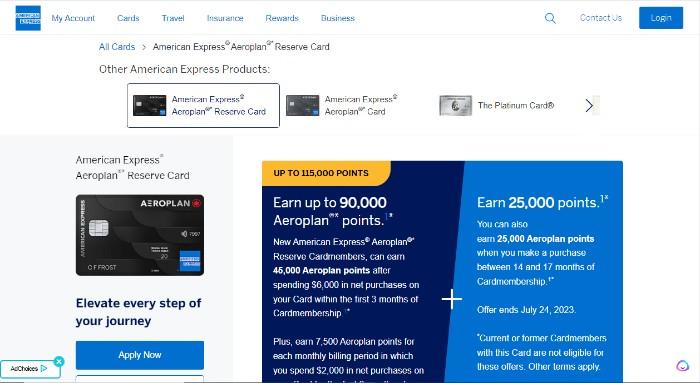

4. American Express® Aeroplan® Reserve Card

· Insurance for travel and shopping covers a variety of different situations.

· You can purchase tickets early by taking advantage of the presale or making reservations.

· Enjoy access to Maple Leaf Lounges.

· You can take advantage of free checked bags for up to eight travelers.

· The expedited security lanes are part of the Priority Airport Services.

· Annual fee of $599.

· Competitive interest rates of 19.99% on purchases and 21.99% on cash advances.

· There is an option to get an Aeroplan Reserve Card for $199 per year, but you can also choose a no-fee option.

· On eligible purchases, you can earn up to three times the points for Air Canada purchases and up to two times the points for other purchases. The minimum points earned per $1 spent is 1.25x.

· The weight of this product is 13 grams and it is made of precisely cut and engraved metal.

· For an annual fee of $199, you can obtain an Aeroplan Reserve Card. However, there is also a no-fee option available.

If you frequently travel, then the American Express Aeroplan Reserve Card, which is a metal credit card in Canada, is a great option. This card offers insurance, rewards, and exclusive benefits when flying with Air Canada. Additionally, you can collect reward points at a faster pace.

If you travel often, you are eligible for many perks including Priority Boarding, one free checked bag, access to Maple Leaf Lounge, Priority Airport Check-In, and the ability to bring up to eight travel companions.

The American Express Reserve Card offers an excellent benefit where cardholders can participate in exclusive events like VIP parties, special dining experiences, and early access to movie screenings.

By obtaining a new card, you can earn a maximum of $2,600 in the first year along with bonus points worth up to $1,700. Additionally, you may receive a credit of up to CAD 100 on your statement every four years if you pay the renewal fee or utilize it for a NEXUS application.

Disadvantage

· The annual fee charged is quite high at $599.

· If you prefer to fly with an airline other than Air Canada, the high earning rate offered may not be beneficial because it is limited to Air Canada travel purchases.

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

5. The Platinum Card® from American Express

American Express Platinum card is one I will certainly recommend to you if you are looking for a travel credit card. here are the key features that will draw you to the card:

· Ext travel and shopping insurance is a type of coverage that pays for expenses related to purchases made during your travels or shopping trips.

· Each year, you are eligible to receive a $200 reimbursement for travel expenses.

· For every dollar you spend, you have the chance to earn up to three times the amount of points.

· You are allowed to make purchases without any monetary limits and settle the payment at a later time.

· The annual cost of this is $699.

· Get the perfect cut and decorate it with special words or pictures that make a statement.

· An all-inclusive travel insurance package

· Annual fees of $175 for Platinum cardholders and $50 for Gold cardholders

· No need to worry about meeting specific financial requirements – this insurance is accessible to all.

· You can access their 24/7 Platinum Concierge service, providing assistance whenever and wherever you need it.

· Lounge perks offer exclusive advantages for events and lounge visits

Consider getting the Platinum card from American Express Canada as it offers impressive advantages and rewards, comes with an introductory offer, and allows you to earn points quickly.

You can enjoy many benefits with premium perks such as access to airport lounges, personalized services, special reservations and recommendations, and exclusive restaurants.

As a new Platinum® Cardmember, you can earn 80,000 points within the first 3 months by spending $7,500 on your card. You will earn 3 points for every $1 spent on food delivery and dining in Canada, 2 points for every $1 spent on travel purchases, and 1 point for every $1 spent on all other purchases.

As a platinum cardholder, you are eligible for an annual $200 travel credit. This credit can be applied towards a trip booking that costs a minimum of $200. To utilize this benefit, simply visit the American Express Travel page and select ‘Apply now’

Disadvantage

· Individuals who are 65 years of age or older do not have medical coverage.

· If you don’t travel often, it may be difficult for you to justify paying an annual fee of $699.

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

6. American Express® Gold Rewards Card

· Presale tickets allow you to purchase tickets before the show and provide early access. · Reserved tickets are designated seats that will be held for you at the show.

· The perk of global airport lounge access enables you to enter specific airport lounges worldwide.

· There is no requirement to demonstrate the amount of money you possess.

· Insurance can cover expenses related to travel and purchasing items.

· The perk of global airport lounge access enables you to enter select airport lounges worldwide.

· You will receive $100 annually that can be used towards travel.

· You will be charged 20.99% interest if you make a purchase.

· Every year, you’ll need to pay $250.

· This product consists of 13 grams of stainless steel and is available in gold or rose gold.

· In Canada, you can earn twice the points when you make purchases such as gas, groceries, and drugs. Additionally, you can earn double points when you travel.

· If you receive cash, you will be charged a 21.99% interest rate.

If you’re looking for a luxurious and flexible option, the American Express Gold Rewards Card is the top choice for a metal credit card in Canada. This premium card comes with various perks like travel upgrades, airport lounge access, and credits for hotel spa treatments and meals.

You can use the American Express Gold Rewards Card for different purchases, including rewards programs. Also, the card’s elegant design in rose gold adds to its visual appeal.

You will receive a welcome bonus of $600 worth of points from eligible travel purchases, which can be redeemed for travel, shopping, and more.

Additionally, if you have a Gold Rewards Card, you will get complimentary access to Priority PassTM, which grants you access to airport lounges.

And to me, that’s quite awesome because that way, you can enjoy a nice and comfortable environment while waiting for your flight. You can also get free visits to Plaza Premium Lounges in Canada every year. You get 4 visits.

As a cardholder, if you make eligible purchases such as travel, groceries, and gas using your card, you will earn 2 points for every $1 spent. For all other qualifying purchases, you will receive 1 point for every $1 spent.

Disadvantage

· Travelers aged 65 or older are not covered by emergency medical insurance.

· If you travel frequently, you can use up the four free passes to Plaza Premium Lounges quickly.

7. American Express® Aeroplan®* Business Reserve Card

· Newbie Tip: Around 85,000 points

· Interest rates: 16.99% to 21.99%

· Yearly Cost: $599

The American Express Aeroplan Business Reserve Card is a reputable metal credit card in Canada that provides various conveniences and comfort. Despite the high annual fee, it offers extensive travel benefits, strong earning rates, and low-interest charges.

With the American Express® Aeroplan®* Business Reserve Card, you can earn bonus points during the first six months, particularly when renting cars, booking hotels, and buying travel items such as plane tickets.

Besides, this card is packed with special perks like priority upgrades and airport lounge access that can make your travels more convenient and enjoyable.

With the American Express® Aeroplan®* Business Reserve Card, you can enjoy access to over 1,200 Priority Pass™ airport lounges worldwide, as well as Air Canada Maple Leaf Lounges™ and Air Canada Café™.

The business reserve card provides tools that assist with managing your business from any location and at any time, enabling you to take control of your business.

Disadvantage

· The Annual Worldwide Companion Pass is not available for every business

· The annual fee is high

· If you skip or miss a payment, the purchase percentage increases to 23.99%.

Know How To Discard A Metal Card

There have been inquiries about how to dispose of a metal card. And yes, It is certainly possible to dispose of a metal card.

So to avoid any risk of someone else using your metal card, you should either destroy it at home or return it by mail to your provider or the bank where you received it. It is not recommended to simply throw it away.

Metal Credit In Canada

- In Canada, possessing a metal credit card is more than just a financial tool – it symbolizes sophistication and privilege. Not everyone can simply possess it; one must meet specific qualifications and standards to qualify.

Frequently Asked Questions

Q1: What can you gain from the BMO Eclipse Visa Infinite Privilege Card?

The card comes with benefits such as earning 5 times the points on groceries, drugstore items, travel, gas, and dining. Additionally, it provides an annual $200 trip benefit, 6 airport lounge access per year, and 25% more points when you add an authorized user to the card.

Q2: How much does it cost me to have a metal credit card in Canada?

Metal credit cards often have an annual fee attached to them, including the BMO Eclipse Visa Infinite Privilege Card which has a $499 annual fee.

Q3: Does my Metal credit card have a limit on the number of reward points that can be earned?

The accelerated earning rate on the BMO Eclipse Visa Infinite Privilege Card is limited to a maximum annual spending amount of $100,000.

Q4: Is American Express accepted by this card?

Yes, Your business can accept American Express cards with this card, which makes it convenient for customers who prefer to pay with AMEX.

However, it will come at a higher cost to your business due to the additional fees. But it will also provide customers with added convenience and access.

Conclusion

To access expensive premium benefits directly in Canada, it is important to have a metal card.

However, before making a choice, compare the rates, fees, terms, and conditions of different cards. When it comes to credit cards, choose a trustworthy financial institution as they are more secure.

It is not recommended to get a credit card from a third-party insurer online as it can be risky.