The Simplii High-Interest Savings account is that savings account you are craving! Not only will it help you prepare for future financial spending and special projects, but it’ll also earn you higher interest. Perfect for those rainy days too!

Why are savings accounts so important? Well, without them, inflation could slowly chip away at the value of your hard-earned money.

In this article, we’ll dive into the world of Simplii’s high-interest account, high-interest savings accounts, and other concepts that will make your savings grow. Get ready for some interesting and yielding savings!

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

Simplii High-Interest Accounts Savings Account

- The Simplii High-Interest Savings account is that savings account you are craving! Not only will it help you prepare for future financial spending and special projects, but it’ll also earn you higher interest. Perfect for those rainy days too!

- In this article, we’ll dive into the world of Simplii’s high interest account, high interest savings accounts, and other concepts that will make your savings grow. Get ready for some interesting and yielding savings!

Understanding High-Interest Savings Account

A High-Interest Savings Account (HISA) is like a special savings account provided by banks or financial institutions. It gives you an interest rate that’s higher than a regular savings account.

You get the higher interest rate because, for a HISA, you usually need to start with a bigger deposit or keep a minimum balance. Also, there are limits on how many times you can take out money or move it around each month.

HISAs are considered a safe way to invest because the government insures your deposit up to a certain amount. But remember, the interest you earn might be taxable, and the interest rate can change over time.

If you’re looking to save money in a low-risk investment with a higher interest rate than a regular savings account, a HISA could be a good option for you. It’s also good if you want to have access to your savings whenever you need it, as you can usually take out money whenever you want.

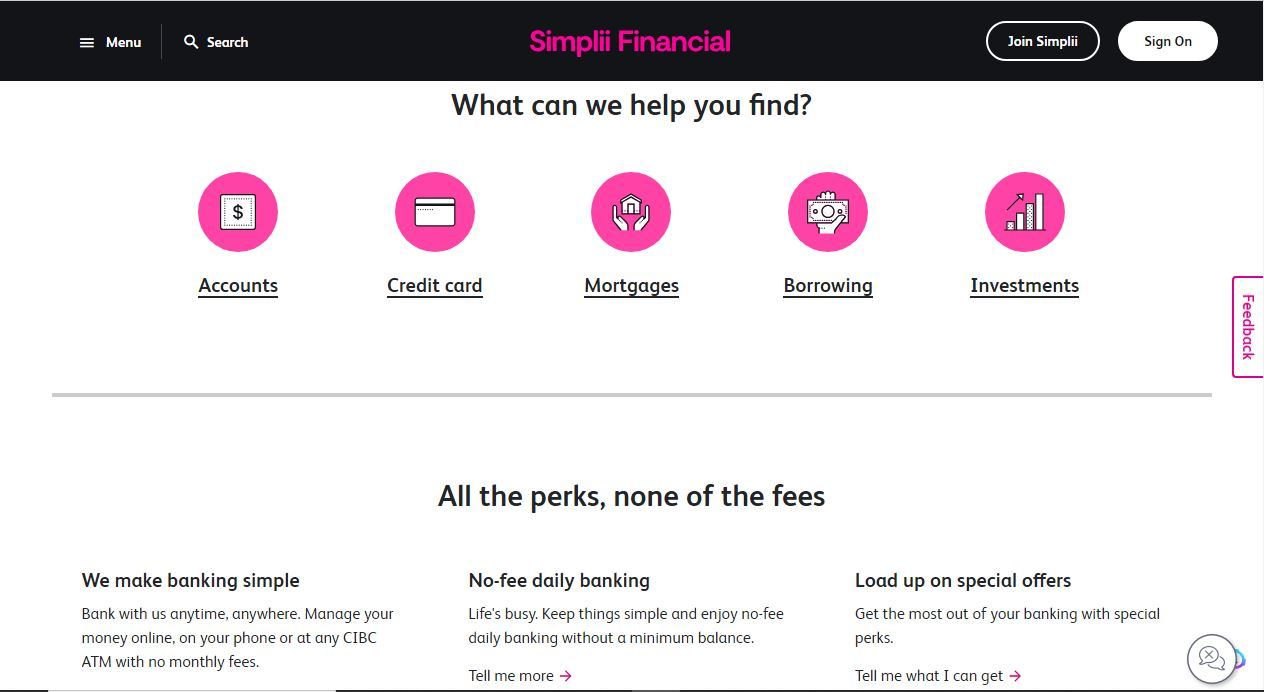

What is Simplii Financial?

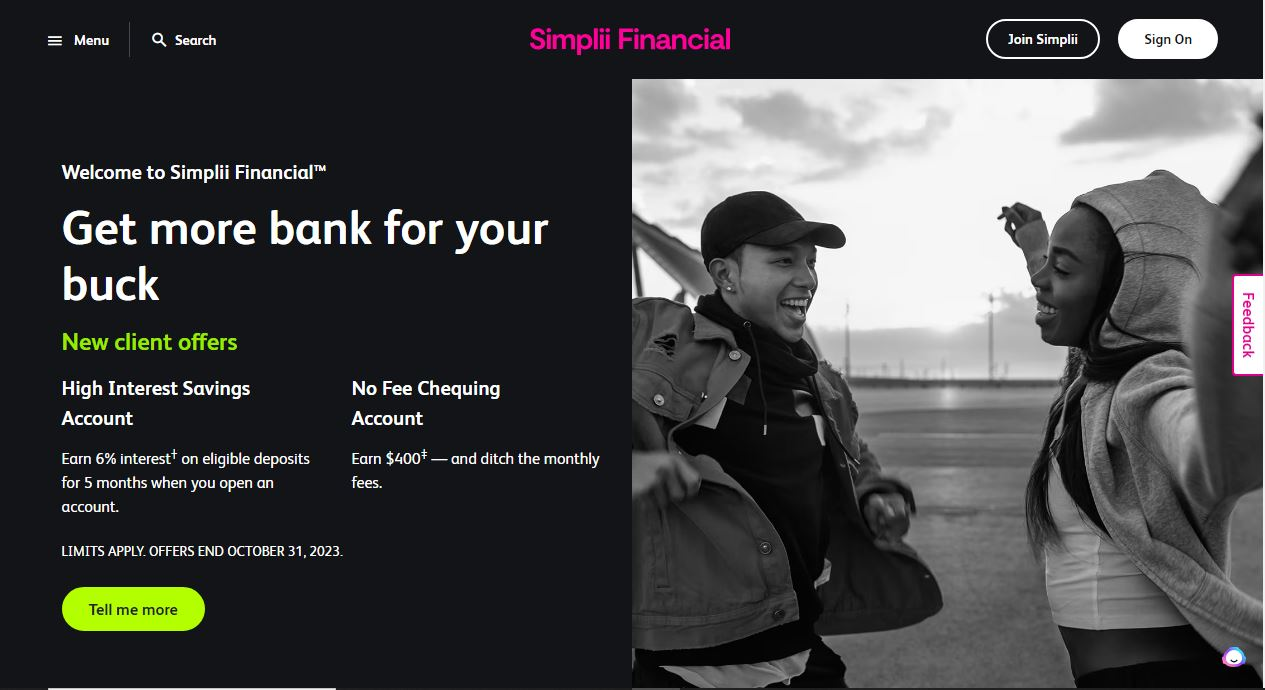

Simplii Financial is a Canadian direct banking brand owned by the Canadian Imperial Bank of Commerce (CIBC). It offers a range of financial products and services through its website and mobile app.

They have no-fee chequing accounts, high-interest savings accounts, and competitive rates on mortgages and personal loans. Simplii Financial is known for its user-friendly digital banking platform, making it a convenient and low-cost banking option for Canadians.

Launched in 2017, Simplii Financial is an online-web-based financial institution where customers can manage their accounts, pay bills, transfer funds, and deposit cheques using digital channels. With their simplified approach to banking, Simplii Financial has gained popularity among millions of Canadians.

Simplii Financial offers various financial services, including:

Bank Accounts: Get chequing accounts and high-interest savings.

Credit and Lending: Access credit cards, mortgages, personal loans, and lines of credit.

Investment Products: Choose from Tax-Free Savings Accounts (TFSAs), registered retirement savings plans (RRSPs), guaranteed investment certificates (GICs), and mutual funds.

Let’s Discuss Simplii High-Interest Savings Account

Simplii Financial’s High-Interest Savings Account (HISA) is a savings account that gives you a great interest rate and easy access to your money.

With Simplii high-interest savings, you get different interest rates based on your balance. And if you’re a new client, you’ll enjoy one of the best interest rates in Canada at 5.25%.

Step By Step Way To Open Simplii High-Interest Savings Account

To open a Simplii High-Interest Savings Account, you can follow these steps:

1. Head to the Simplii Financial website or download their mobile app.

2. Look for the “Open an Account” or “Get Started” button on the homepage.

3. Choose the “Savings Account” option from the list.

4. Fill out the application form with your details, like your name, address, and Social Insurance Number (SIN).

5. Once you’ve submitted your application, Simplii Financial will review it and reach out if they need any additional info.

6. After your account is approved, you can transfer money from another bank account or set up a direct deposit to fund it. Start earning interest on your savings right away.

7. If you have any questions or need assistance, you can easily chat with a live agent through your online or mobile banking.

If you want to open a Simplii High-Interest Savings Account, here’s what you need to know:

1. Support available: You get an embrace when asking questions about opening your account, Feel free to reach out to Simplii Financial’s customer service team. They are ready and available to assist you.

2. Documents needed: To complete the application process, you will be required to submit proof of your identity and address. Examples of acceptable documents include a driver’s license or a utility bill.

3. Eligibility: To create an account, you need to be a Canadian resident who is at least 18 years old and residing outside of Quebec.

4. Required information: Your social insurance number (SIN) must be intact and I mean, you must make it available and ready

Looking for special offers on Simplii Financial high-interest accounts?

Simplii Financial welcomes its diverse customer base with a plethora of special offers and bonuses. I will want to take advantage of perks and offers like these, which include:

1. Promotional offer of 5.2% interest when you open a new Simplii Financial high-interest savings account as a new client.

2. You also get access to a fee-free Simplii chequing account as a welcome bonus perk for your Simplii Financial account

3. You can also Refer friends to Simplii Financial and receive a $50 bonus deposited into your account. There is no limit to the number of referrals you can make.

The Competitive Rates and Fees of Simplii Financial’s High-Interest Account

Simplii Financial offers a high-interest rate that changes based on your bank account balance. The best part is, that there are no monthly fees for Simplii Financial customers. Check out the table below to see the interest rates Simplii Financial offers for savings based on your balance.

Account Balance Range Annual Rates

$0.00 to $50,000.00 0.40%

$50,0000.01 to $100,000.00 0.40%

$100,000.01 to $500,000.00 0.40%

$500,000.01 to $1,000,000.00 1.00%

$1,000,000.01 and up 2.00%

I want you to be aware that the interest rate on your Simplii Financial customer account is determined by multiplying the daily interest rate (which is based on the annual rate) by your account’s daily closing balance. This calculated amount is then credited to your account every month. It is important to note that Simplii Financial reserves the right to modify interest rates without prior notice.

Simplii High-Interest Accounts Savings Account

- The Simplii High-Interest Savings account is that savings account you are craving! Not only will it help you prepare for future financial spending and special projects, but it’ll also earn you higher interest. Perfect for those rainy days too!

- In this article, we’ll dive into the world of Simplii’s high interest account, high interest savings accounts, and other concepts that will make your savings grow. Get ready for some interesting and yielding savings!

The Upsides and Downsides of Simplii High Interest Savings Accounts

The Simplii Financial high-interest account offers various pros and cons. Let’s explore them in a straightforward and easy-to-understand manner.

Upside

1. No monthly fees

2. No transaction fees

3. Referral bonus of up to $50 when you refer someone to Simplii Financial.

4. New client interest rate of 5.25%

5. No minimum balance is required to operate the account

Downside

1.In some cases, instant access may not be provided.

2. Unfortunately, residents of Quebec cannot access the high-interest account.

Enhanced Protection for Simplii Financial Funds

Simplii is a Canadian Schedule 1 bank that is fully regulated. It is owned by the Canadian Imperial Bank of Commerce (CIBC).

If Simplii fails or goes bankrupt, your deposited funds are insured by the Canadian Deposit Insurance Corporation (CDIC), providing up to $100,000 in coverage. Similar to traditional banks in Canada, digital banks like Simplii Financial are also highly regulated.

How exactly does a high-yield savings account function?

A high-interest savings account, also known as HISA, is similar to a regular savings account but offers a higher interest rate. The main goal of a HISA is to incentivize saving by providing better interest rates on deposits. Here’s how it works:

Deposit money: You can add money to your HISA through electronic transfers, direct deposits, or by depositing cheques.

Earn interest: The interest rate on a HISA is usually higher compared to a regular savings account. Interest is calculated daily and paid monthly or quarterly, depending on the version.

Flexible withdrawals: Unlike fixed-term investments, HISAs allow you to withdraw money when needed without penalties. However, some HISAs may have limits on monthly withdrawals or charge fees for excessive withdrawals.

Deposit insurance: In Canada, most HISAs are insured by the Canada Deposit Insurance Corporation (CDIC). Each depositor is covered up to $100,000 per insured category.

Account Monitoring: You have the option to conveniently monitor your account online. With most High-Interest Savings Accounts (HISAs) being offered online only, you can easily keep track of your balance and transactions through an online platform or a user-friendly mobile application.

High-interest Savings Account: The Regulations

The Canadian government establishes and enforces rules for high-interest savings accounts (HISAs) which are offered by financial institutions. Here are some key regulations that apply to HISAs in Canada:

Money Withdrawals:

Withdrawing money from a High-Interest Savings Account (HISA) is generally easy and penalty-free. However, certain accounts may have limits on the number of withdrawals or charge fees for excessive ones. Additionally, there may be a minimum withdrawal amount in certain cases.

Eligibility:

To open a HISA in Canada, you must be a Canadian resident and meet the age requirements set by the financial institution. Some HISAs may have additional eligibility requirements, such as minimum income or credit score requirements.

Pricing:

Most High-Interest Savings Accounts (HISAs) don’t typically come with monthly fees. However, some accounts may have charges for specific transactions or excessive withdrawals. It’s crucial to review the fee schedule of any HISA you’re considering to grasp the associated costs.

Insurance for deposits:

In Canada, most High-Interest Savings Accounts (HISAs) are insured by the Canada Deposit Insurance Corporation (CDIC). This means that if the bank where you have your HISA goes bankrupt or can’t pay its debts, your deposits will still be safe. CDIC protection covers up to $100,000 per depositor per insured category. So, you can rest easy knowing your money is protected up to the insured limit.

Rates of interest:

Financial institutions are not obligated to provide a minimum interest rate on High-Interest Savings Accounts (HISAs). This leads to a wide variation in interest rates across different HISAs. Some institutions may offer promotional rates to attract new customers, while others adjust their rates according to market changes.

Investment In High-Interest Savings Account

Investing in High-Interest Savings Accounts (HISAs) can be a smart choice for those seeking low-risk opportunities to earn returns on their savings. Here are a few reasons why HISAs can be a favorable investment option:

Liquidity:

High-Interest Savings Accounts (HISAs) provide excellent liquidity, allowing you to access your funds without any penalties. This makes HISAs a great choice for individuals who require quick access to their funds or prefer investment flexibility.

Competitive interest rates:

HISAs, or High-Interest Savings Accounts, often provide more competitive interest rates compared to regular savings accounts. By opting for an HISA, you can potentially earn a higher return on your investment in the long run.

Minimal risk:

High-Interest Savings Accounts (HISAs) are commonly seen as low-risk investments. They are typically offered by well-established financial institutions and come with insurance from the Canadian Deposit Insurance Corporation (CDIC). As a result, your investment in a HISA is protected up to a certain limit, ensuring minimal risk of loss.

Assured profit:

High-Interest Savings Accounts (HISAs) differ from stocks or mutual funds as they provide a guaranteed return on investment through interest. This means you will earn a fixed amount of interest, irrespective of market conditions.

HISAs may not be the ideal choice for everyone when it comes to investments. For instance, those with a longer investment timeline or individuals who are willing to take on higher risks might find other options like stocks or mutual funds more suitable.

Simplii High-Interest Accounts Savings Account

- The Simplii High-Interest Savings account is that savings account you are craving! Not only will it help you prepare for future financial spending and special projects, but it’ll also earn you higher interest. Perfect for those rainy days too!

- In this article, we’ll dive into the world of Simplii’s high interest account, high interest savings accounts, and other concepts that will make your savings grow. Get ready for some interesting and yielding savings!

High-Interest Savings Account Dues

The interest earned on a High-Interest Savings Account (HISA) is taxable in Canada, as per the Canadian Revenue Agency. Here’s what you should know about taxes on HISA:

Rate of Tax:

The tax you owe on your HISA interest will vary based on your marginal tax rate, which is determined by your total taxable income for the year.

Registered HISAs:

Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs) are registered HISAs that provide tax advantages. With a TFSA, the interest earned is not taxed, and contributions made to an RRSP reduce taxable income. These options help minimize taxes on HISA interest earnings.

Taxable earnings:

Interest earned on a HISA is treated as taxable income and should be declared on your annual income tax return for the respective year.

T5 statement:

By the end of February each year, financial institutions must provide customers with a T5 statement. This statement outlines the interest earned on your HISA during the previous tax year and should be used when preparing your income tax return.

Conclusion

You looking to earn interest on their savings have a great option with HISA. Simplii, a digital bank fully owned by the Canadian Imperial Bank of Commerce, offers HISA accounts. By following the information provided in this guide, you can easily open a HISA account with Simplii and start earning attractive interest on your savings.