TD Travel Insurance is a type of travel insurance offered by TD Bank, one of the largest banks in Canada. TD Travel Insurance covers unexpected events during your trip, such as trip cancellation, emergency medical expenses, lost baggage, and more. This guide will give you everything you need about TD Travel insurance.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

What You Must Know About TD Travel Insurance

- TD Travel Insurance is a type of travel insurance offered by TD Bank, one of the largest banks in Canada. TD Travel Insurance covers unexpected events during your trip, such as trip cancellation, emergency medical expenses, lost baggage, and more. This guide will give you everything you need about TD Travel insurance

What are the Key Features of TD Travel Insurance?

The key features of TD Travel Insurance can vary depending on the specific plan and coverage you choose. However, here are some standard key features that you may find in TD Travel Insurance policies:

Trip Cancellation and Interruption:

TD Travel Insurance typically includes coverage for trip cancellation or interruption due to covered reasons, such as illness, injury, or death of a family member. This coverage helps reimburse you for non-refundable expenses like flights, accommodations, and tours.

Emergency Medical Coverage:

TD Travel Insurance covers emergency medical expenses incurred while traveling. This includes coverage for hospital stays, physician services, prescription medications, and emergency medical transportation. The coverage aims to alleviate the financial burden of unexpected medical emergencies while you are away from home.

Baggage and Personal Belongings Coverage:

TD Travel Insurance often includes coverage for lost, stolen, or damaged baggage and personal belongings. This coverage helps reimburse you for the value of your belongings, allowing you to replace essential items. It may also include coverage for delayed baggage, providing reimbursement for necessary purchases during the delay.

Trip Delay Coverage:

TD Travel Insurance may offer coverage for trip delays due to covered reasons beyond your control. This coverage can help reimburse you for additional expenses incurred, such as accommodations, meals, and transportation, during the delayed period.

24/7 Travel Assistance:

Many TD Travel Insurance plans provide access to 24/7 travel assistance services. This service allows you to reach out for emergency help, travel information, and general assistance while traveling. The assistance can be valuable in unfamiliar situations or when you require guidance during your trip.

Accidental Death and Dismemberment Coverage:

In the unfortunate event of accidental death or permanent disability while traveling, this coverage benefits you or your beneficiaries.

Rental Car Coverage:

TD Travel Insurance may offer coverage for damage or theft of rental vehicles while you are traveling.

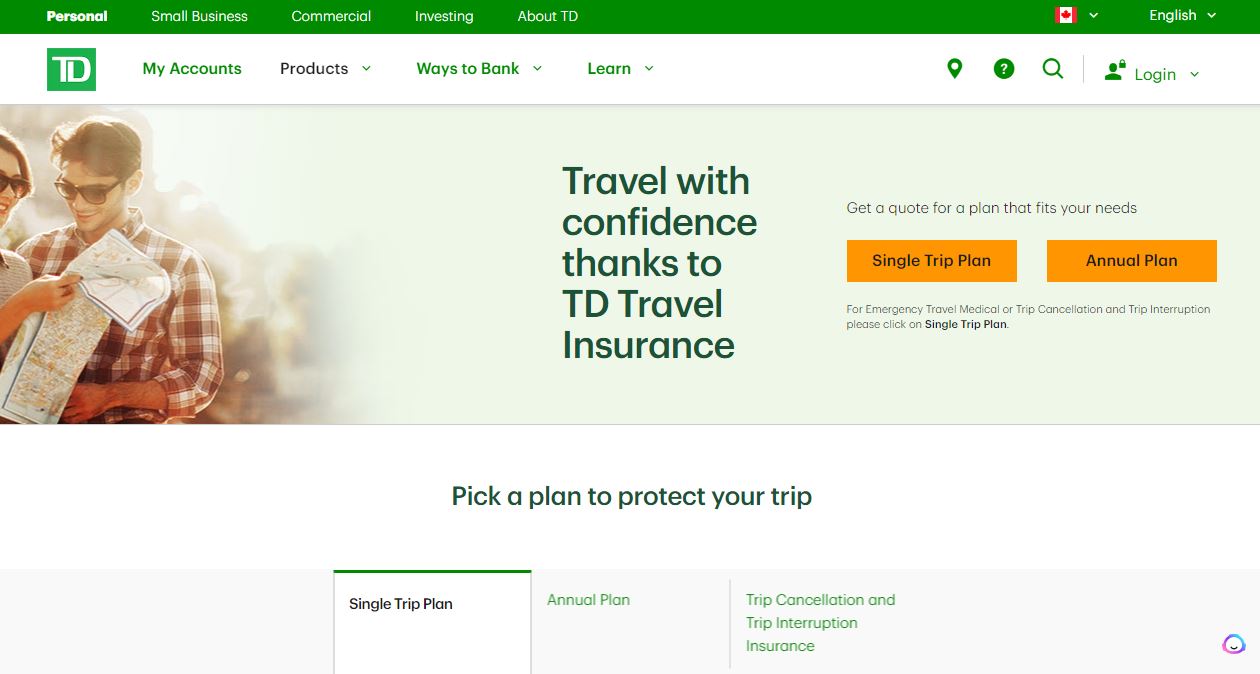

TD Travel Insurance Plans

TD Travel Insurance offers various travel insurance plans to cater to different travelers’ needs and preferences. The insurance coverage plan is designed to meet the needs of different travelers. The major TD Insurance plans designed to meet the diverse needs of travelers include:

- Single Trip – Single trip offers access to 24/7 worldwide emergency assistance. It provides an option for couple or family plans, and the coverage lasts for up to 212 days of travel.

- Annual −This is best suited for frequent travelers. Annual plans offer unlimited trips of 9, 17, 30, or 60 days during the year. Additionally, they provide up to $5 million of comprehensive medical emergency coverage with no deductible required.

TD offers four major coverage plans, and they are as follows:

TD Multi-Trip All-Inclusive Package:

This is the most comprehensive TD travel plan. It combines trip cancellation/interruption coverage, up to $5 million worth of emergency medical coverage, and other benefits such as baggage loss/delay coverage, travel accident insurance, and travel assistance services.

Trip Cancellation and Trip Interruption Insurance: This plan is suitable if you do not want emergency medical coverage but financial protection for approved non-medical expenses, such as your trip being interrupted or canceled due to an event covered by the plan.

TD Insurance Single Trip Medical Plan:

This plan covers emergency medical expenses incurred while traveling, including hospital stays, physician services, prescription medications, and emergency medical transportation. It provides up to $5 million of emergency medical coverage for one trip.

TD Insurance Multi-Trip Medical Plan:

This plan suits people who travel often. It is more cost-effective than going for a single-trip plan each time you want to travel. It provides up to $5 million worth of emergency medical coverage for each covered trip for the maximum trip duration within one calendar year,

It’s important to note that the availability and specifics of TD Travel Insurance plans may vary based on factors such as your location and the current offerings at TD Bank. It’s recommended to directly contact TD Bank or visit their official website before choosing which to go for. Additionally, TD offers travel tips and guidelines for its travelers.

How to Get TD Travel Insurance

To obtain TD Travel Insurance, you can typically purchase it directly from TD Bank or through their website. It’s recommended to contact TD Bank or visit their official website for the most up-to-date information.

TD Travel Insurance Eligibility

The eligibility requirements for TD Travel Insurance can vary depending on the specific plan and coverage you are applying for. Here are some of the general eligibility.

- Age Requirements: TD Travel Insurance typically has age restrictions for coverage. The minimum and maximum age limits may vary based on the plan and type of coverage you are seeking. Reviewing the specific age requirements outlined in the policy documents is essential.

- Residency: TD Travel Insurance is often available to residents of the country or region where TD Bank operates. The specific residency requirements may vary depending on the plan and the country where you are applying for coverage.

- Pre-existing Medical Conditions: TD Travel Insurance may have limitations or exclusions related to pre-existing medical conditions. Depending on the plan, you may need to meet certain criteria or undergo a medical assessment to determine if coverage can be provided for pre-existing conditions.

- Trip Details: The eligibility for TD Travel Insurance coverage may depend on the details of your trip, such as the destination, duration, and purpose. Some plans may have restrictions on coverage for certain high-risk activities or destinations.

What You Must Know About TD Travel Insurance

- TD Travel Insurance is a type of travel insurance offered by TD Bank, one of the largest banks in Canada. TD Travel Insurance covers unexpected events during your trip, such as trip cancellation, emergency medical expenses, lost baggage, and more. This guide will give you everything you need about TD Travel insurance

What Are TD Travel Insurance Exclusions

Like any insurance policy, TD Travel Insurance typically includes specific exclusions that specify situations or circumstances where coverage may not apply. While the particular exclusions may vary depending on the policy and coverage you choose, here are some standard exclusions that may apply to TD Travel Insurance:

- Pre-existing Medical Conditions: TD Travel Insurance may have exclusions or limitations on coverage related to pre-existing medical conditions. This means that expenses arising from a medical condition that existed before purchasing the policy may not be covered.

- High-Risk Activities: Certain high-risk activities, such as extreme sports or adventure activities, may be excluded from coverage. Reviewing the policy documentation to understand which activities are excluded from coverage should be among the first thing to do.

- Intentional Acts: TD Travel Insurance typically excludes coverage for expenses resulting from intentional self-inflicted harm or illegal activities.

- War and Terrorism: Expenses from traveling to regions surrounded by acts of war, terrorism, civil unrest, or nuclear events are often excluded from coverage.

- Non-Compliance with Laws: Coverage may be excluded if you engage in activities or actions that violate the laws or regulations of the country you are visiting.

- Travel to Restricted Areas: TD Travel Insurance may exclude coverage for travel to certain high-risk or restricted areas as determined by government authorities or travel advisories.

- Pregnancy and Childbirth: Some policies may have exclusions related to pregnancy and childbirth, including expenses associated with routine prenatal care or childbirth.

These are examples of standard exclusions that may apply to TD Travel Insurance. It’s crucial to carefully review the policy documents, terms, and conditions to understand the specific exclusions that pertain to the policy you are considering. The policy documents will provide detailed information about the exclusions, limitations, and other conditions affecting coverage.

Who owns TD Insurance?

TD Insurance is owned by the Toronto-Dominion Bank, commonly called TD Bank Group. TD Bank Group is a Canadian multinational banking and financial services corporation. It is one of the largest banks in Canada and has a significant presence in the United States. TD Bank Group owns and operates various subsidiaries, including TD Canada Trust and TD Bank, retail banking divisions in Canada and the United States.

Is TD Insurance the same as TD Bank

No, they are not the same. TD Insurance is a division of TD Bank Group. TD Bank Group is a Canadian multinational banking and financial services corporation that offers a wide range of financial products and services, including banking, wealth management, and insurance. TD Insurance is the insurance arm of TD Bank Group and provides various insurance products, including home insurance, auto insurance, travel insurance, life insurance, and more. TD Insurance operates within the larger framework of TD Bank Group but focuses specifically on insurance offerings.

How To Contact TD Insurance

You can reach TD Insurance by phone. For general inquiries, contact the TD Insurance Customer Service line at Call our Administrator 24/7 at 1-800-359-6704 toll-free from Canada or the U.S. or +1-416-977-5040 when calling from other countries. Also, you can visit their official website.

Does TD Debit Card Have Travel Insurance?

TD Aeroplan and TD Travel Credit Cards have travel insurance that offers valuable travel insurance benefits such as Trip Interruption Insurance, Delayed & Lost Baggage Insurance, Emergency Travel Assistance Services, and Emergency Travel Medical Insurance.

How Do I Inform TD Of Travel Plans?

Call TD at 1-888-568-7130 one week beforehand to inform them of your travel plans. If you are using your card, you must let them know to avoid any interruptions at the TD Connect Card service.

How Do I Claim Travel Insurance?

To claim travel insurance, ask your insurer for a claim form. Complete the claim form accurately, keep a copy for yourself, and send the original to TD. Attach copies of all paperwork related to your claim, including medical certificates and receipts.

TD Travel Insurance Limitation

While TD Travel Insurance offers various benefits, it’s essential to be aware of potential drawbacks or limitations. Here are a few drawbacks that you should consider:

Coverage Limitations:

TD Travel Insurance policies typically have certain limitations and exclusions. These limitations may restrict coverage for pre-existing medical conditions, high-risk activities, or certain destinations. It’s important to carefully review the policy documentation to understand any limitations or exclusions that may apply to your situation.

Waiting Periods:

Some TD Travel Insurance policies may have waiting periods before certain coverages become effective. For example, coverage for pre-existing medical conditions may require a waiting period, meaning you may not be eligible for reimbursement if a medical issue arises shortly after purchasing the policy.

Policy Costs:

The cost of TD Travel Insurance can vary depending on factors such as your age, trip duration, coverage limits, and destination. While travel insurance is designed to provide financial protection, the premiums can be an additional expense, especially for longer trips or if you require extensive coverage.

Policy Conditions and Requirements:

TD Travel Insurance, like other insurance policies, may have specific conditions and requirements that must be met to be eligible for coverage. For instance, you may need to provide proper documentation or follow particular procedures in the event of a claim. Failure to meet these requirements may result in denial of coverage.

Limited Reimbursement:

TD Travel Insurance typically reimburses covered expenses up to specified limits. These limits may not fully cover all costs incurred during a trip, particularly in cases of expensive medical treatments or high-value items lost or damaged.

What You Must Know About TD Travel Insurance

- TD Travel Insurance is a type of travel insurance offered by TD Bank, one of the largest banks in Canada. TD Travel Insurance covers unexpected events during your trip, such as trip cancellation, emergency medical expenses, lost baggage, and more. This guide will give you everything you need about TD Travel insurance

Conclusion

It’s important to carefully review the policy documents, including the terms, conditions, limitations, and exclusions of TD Travel Insurance, before purchasing it. Understanding the coverage areas, potential drawbacks, and limitations can help you make an informed decision and consider whether additional coverage or alternative insurance options may be necessary for your specific needs.