You MUST Have a Separate Business Account – Here’s Why!

Alright, you are starting or currently running a business in Canada? Then you must have a dedicated business account. And not just any account – knowing the BEST one for your business is essential.

Unlike personal bank accounts, business accounts in Canada have their own nuances. That’s why it’s crucial to understand which account is the perfect fit for your unique business.

In this comprehensive guide, we’ll walk you through the different types of business accounts available in Canada. We’ll explore their advantages and disadvantages, and also provide valuable insights on other important aspects of opening an account in Canada.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

The 15- Best Business Bank Account Canada For You- 2023

- Alright, you are starting or currently running a business in Canada? Then you must have a dedicated business account. And not just any account – knowing the BEST one for your business is essential.

- Unlike personal bank accounts, business accounts in Canada have their own nuances. That’s why it’s crucial to understand which account is the perfect fit for your unique business.

- In this comprehensive guide, we’ll walk you through the different types of business accounts available in Canada. We’ll explore their advantages and disadvantages, and also provide valuable insights on other important aspects of opening an account in Canada.

Everything You Need To Open a Business Bank Account in Canada

Opening a business account in Canada is easier than ever with our simplified list of required documents. Whether you run a sole proprietorship, partnership, or corporation, we’ve got you covered.

Opening a business account in Canada is easier than ever with our simplified list of required documents. Whether you run a sole proprietorship, partnership, or corporation, we’ve got you covered.

To get started, all you need are these three key documents:

1. Social Insurance Number: Ensure you have this vital piece of information handy.

2. Full Name and Address Proof: You will need to verify your contact information. Simply take along a document showing your full name and current address.

3. Government-issued ID: Providing proof of your identity is crucial. Don’t worry, any valid ID will do!

Depending on the nature and structure of your business, you’ll also need a selection of supporting documents. Our experts will guide you through this process to ensure a smooth and seamless account opening experience.

For a sole proprietorship, you’ll need:

– Master business license or Trade name registration certificate

If you’re in a partnership, be prepared with:

– Declaration of partnership that is registered

– IDs of all partners involved

– Certification of business name registration or master business license (if required)

For a corporation, make sure you have:

– Copy of the corporation’s annual financial return or report (if applicable)

– Information (address, occupation, and name) of all owners with at least 25% ownership

– Canada Revenue Agency registration number

– Articles of incorporation/association

– Certification of business name registration or master business license (if required)

Please note that requirements may vary slightly, so it’s always a good idea to check the website of your preferred financial institution.

Top Business Accounts for Canadian Businesses

There is a wide range of bank accounts available to you as a Canadian business owner that can greatly enhance the efficiency of your operations. Gain insights on the top business accounts in Canada:

TD Unlimited Business Plan: Unlock the potential of unlimited transactions.

BMO Business Builder 1: Fuel your business with this exceptional account.

Manulife Business Savings Account: Optimal for balances under $500K.

TD Business Savings Account: Elevate your business with balances over $500K.

Wise Business Account: Connect seamlessly with international employees and vendors.

KOHO Business Account: Experience a new level of financial management.

Scotiabank Unlimited Account: Seamlessly handle high-volume cash deposits.

CIBC Unlimited Business Operating Account: Streamline low-volume cash deposits.

Top Free Business Bank Accounts in Canada

These top free business accounts in Canada are for entrepreneurs who want to save money!

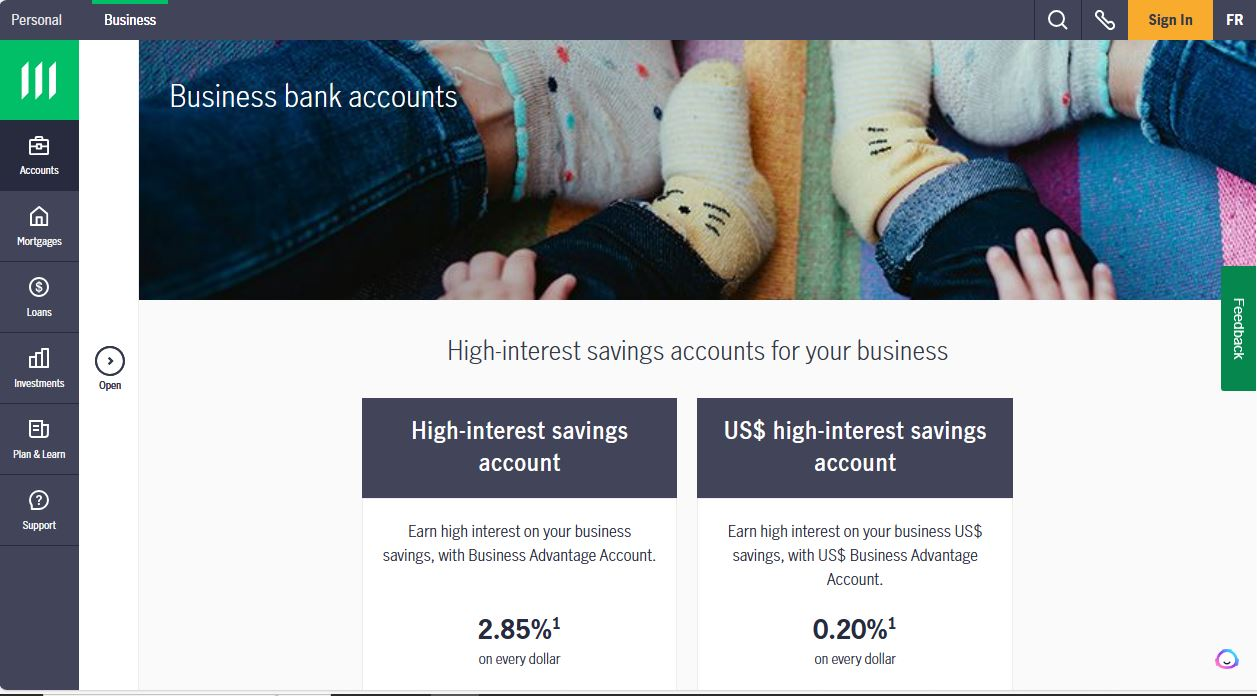

1. Manulife Business Advantage Account

For small and medium-sized enterprises in Canada, Manulife’s Business Advantage Account is a standout choice. Just like the Tangerine account, it’s designed to optimize your savings, especially if you already have a chequing account elsewhere.

For small and medium-sized enterprises in Canada, Manulife’s Business Advantage Account is a standout choice. Just like the Tangerine account, it’s designed to optimize your savings, especially if you already have a chequing account elsewhere.

Benefits

1. Dual Currency Flexibility: Whether you’re saving in Canadian dollars (CAD) or American dollars (USD), this account caters to your needs. Earn a substantial 2.85% interest in CAD and 0.20% in USD.

2. Enhanced Savings: Your business can earn interest on both Canadian and US dollars that aren’t immediately required for daily operations. Maximize your financial potential with ease.

Pricing:

1. Free Fund Transfers: Moving money to other accounts is fee-free, allowing you to efficiently manage your finances.

2. Affordable Bill Payments: Sending money to pay bills and e-Transfers is cost-effective at just $1.00 per transaction.

3. Paper Statement Option: Should you prefer a paper statement each month, it’s available for a nominal fee of $2.00.

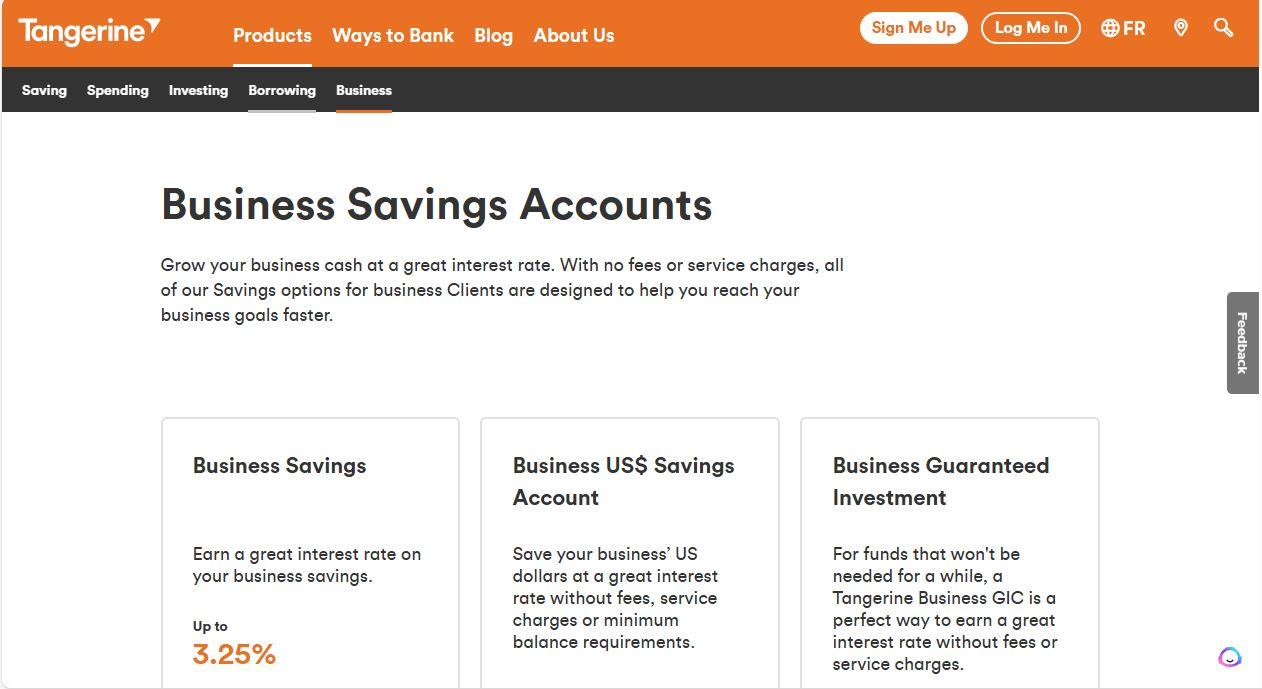

2. Tangerine Business Account:

When it comes to finding the best business bank account in Canada, Tangerine stands out as a top choice. While Tangerine doesn’t offer a traditional business chequing account, it provides a range of accounts perfectly suited to your business needs, including CAD savings, USD savings, and GICs.

When it comes to finding the best business bank account in Canada, Tangerine stands out as a top choice. While Tangerine doesn’t offer a traditional business chequing account, it provides a range of accounts perfectly suited to your business needs, including CAD savings, USD savings, and GICs.

Benefits

1. Competitive Interest Rates: Your business funds can start working for you with the Tangerine Business Savings Account. Here’s how the interest rates stack up:

- For balances from $0 to $99,999.99:

- 2.30% Balances ranging from $100,000 to $499,999.99:

- 2.65% Balances exceeding $500,000: 2.90%

2. Smart Fund Management: With this account, you can earn interest on the money you don’t immediately need for daily operations. It’s a practical way to make your idle funds more productive.

3. Easy Access to Information:

Pricing

The Tangerine Business Savings Account won’t weigh you down with monthly fees. It’s a cost-effective choice for your business finances.

With no Minimum Balance they have made it seamless for you There’s no need to maintain a specific amount in your account, giving you the freedom to manage your finances without restrictions.

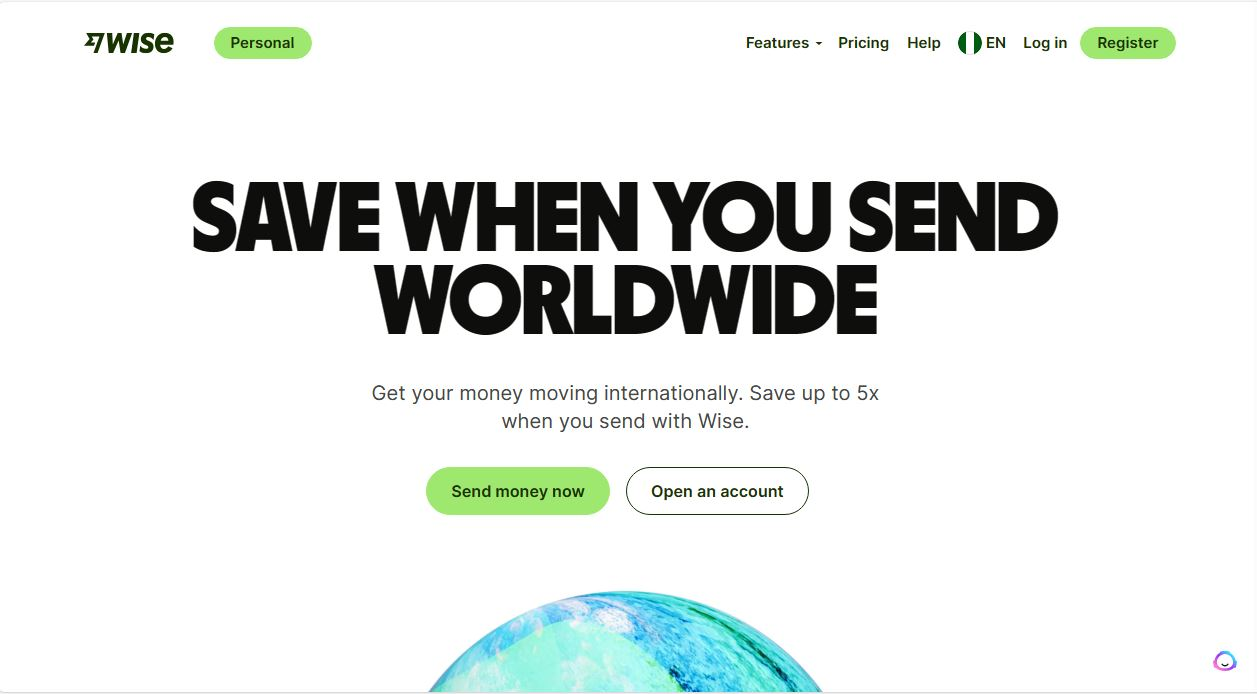

3. Wise Business Account:

The Wise Business Account is ideal for businesses with international employees and vendors. If your business operates globally or works with international employees and vendors, the Wise Business Account is a game-changer.

The Wise Business Account is ideal for businesses with international employees and vendors. If your business operates globally or works with international employees and vendors, the Wise Business Account is a game-changer.

Formerly known as TransferWise, Wise is a leading fintech company that offers a borderless account for businesses to seamlessly send and receive money worldwide. Plus, you can even use Wise for your personal banking needs.

Benefits

1. Multi-currency account: Manage different currencies effortlessly with a Wise Business Account. Streamline your transactions with international clients and vendors hassle-free.

2. Clear and Fair Pricing: No hidden fees or markups. With Wise, you know exactly what you’re paying for, ensuring a fair and transparent deal.

3. User-friendly and convenient: Setting up and using the Wise Business Account is a breeze. Access your account online or through their mobile app, empowering you to manage your finances anytime, anywhere.

4. Affordable international transfer fees: Seamlessly hire international talent or work with freelancers from around the world. Say goodbye to complex money conversions and enjoy the convenience of receiving payments in various currencies.

5. Competitive exchange rates: With real-time exchange rates, Wise ensures you get an edge with highly competitive rates, surpassing traditional banks.

Pricing

Experience all these incredible benefits and more with the Wise Business Account. Plus, enjoy a one-time setup fee of only $42, along with fixed fees for sending money. Harness the power of the mid-market rate and watch your money grow when exchanging currencies.

Maximize your business’s potential on a global scale with the Wise Business Account. Join the ranks of successful businesses worldwide who have transformed the way they do business.

4. Wealthsimple Save For Business Account

This account is tailored to meet the financial needs of companies and organizations across the country. Here’s why it can be one of your top choices:

This account is tailored to meet the financial needs of companies and organizations across the country. Here’s why it can be one of your top choices:

Benefits

1. Competitive Returns: With Wealthsimple Save for Business, your money earns a competitive 1.10% interest rate. Watch your business savings grow effortlessly.

2. Convenient Online Setup: Opening an account is a breeze through their online platform. Simply upload the required business documents to get started.

3. External Account Linking: Before depositing funds, connect an external business account as Wealthsimple doesn’t offer chequing services. This ensures seamless transactions.

Pricing

Monthly Fee-Free: Enjoy the perks of Wealthsimple Save for Business without any monthly charges. Your savings stay intact.

Wealthsimple Save for Business empowers you to maximize your business savings effortlessly. With competitive returns, online convenience, and zero monthly fees, it’s the ideal choice for Canadian businesses. Learn more about Wealthsimple and elevate your business finances today!

The 15- Best Business Bank Account Canada For You- 2023

- Alright, you are starting or currently running a business in Canada? Then you must have a dedicated business account. And not just any account – knowing the BEST one for your business is essential.

- Unlike personal bank accounts, business accounts in Canada have their own nuances. That’s why it’s crucial to understand which account is the perfect fit for your unique business.

- In this comprehensive guide, we’ll walk you through the different types of business accounts available in Canada. We’ll explore their advantages and disadvantages, and also provide valuable insights on other important aspects of opening an account in Canada.

Top Business Bank Accounts with Unlimited Transactions

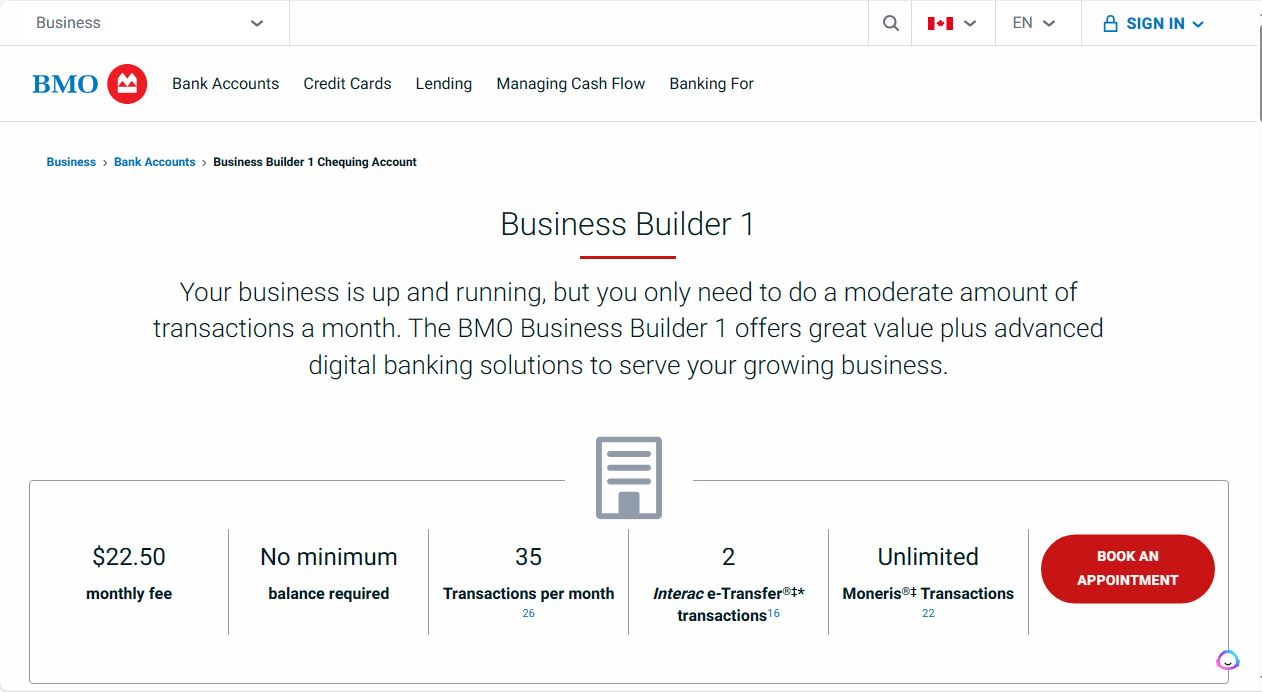

6. BMO Business Builder 1

For small businesses taking their first steps, the BMO Business Builder 1 account offers a perfect financial foundation. This account is crafted to deliver cost-effective banking services, ensuring your business can flourish and thrive.

For small businesses taking their first steps, the BMO Business Builder 1 account offers a perfect financial foundation. This account is crafted to deliver cost-effective banking services, ensuring your business can flourish and thrive.

The BMO Business Builder 1 account is tailored to support your business’s initial growth phase, providing essential services at an affordable price. As your business expands, explore additional banking options to meet your evolving needs.

Benefits:

1. Affordable Banking: Enjoy a wide range of banking services without breaking the bank. The BMO Business Builder 1 account comes with a budget-friendly monthly fee of just $22.5.

2. Easy Account Management: Seamlessly manage your account online, including tasks like checking your balance, transferring funds, and paying bills.

3. Optional Credit Card Processing: Unlock the ability to accept credit card payments from customers with the account’s credit card processing service.

Pricing:

1. Transaction Costs: Electronic transactions cost $0.60, while branch transactions are priced at $1.25 each.

2. Deposits: Depositing cash incurs a fee of $2.25 per $1,000, and coin deposits cost $2.25 for every $100.

3. Paper Statements: Opting for paper statements comes at a monthly cost of $4.00.

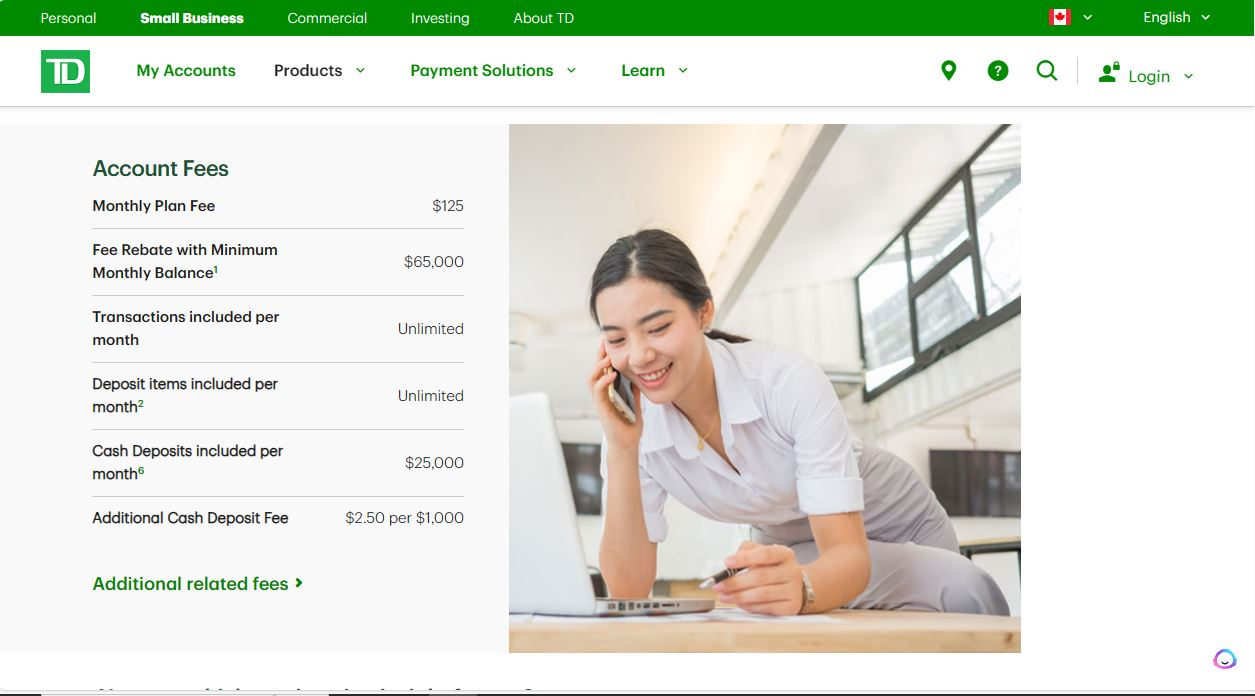

7. TD Unlimited Business Plan:

If your business thrives on frequent transactions, Then I urge you to consider TD Unlimited Business Plan—a Canadian business owner’s dream. Here’s why this account is your best bet:

If your business thrives on frequent transactions, Then I urge you to consider TD Unlimited Business Plan—a Canadian business owner’s dream. Here’s why this account is your best bet:

Benefits:

1. Unlimited Transactions: Enjoy endless possibilities with unlimited electronic, bill payments, POS, and in-branch transactions—all for a fixed monthly fee of $125.

2. CDIC Insurance: Rest easy knowing your deposits are insured by the Canada Deposit Insurance Corporation (CDIC).

3. No Extra Fees: Say goodbye to worries about transaction limits or per-transaction charges. Every transaction is covered under one fixed fee.

4. Money-Back Rewards: When you TD Aeroplan Visa Business Card or TD Business Travel Visa Card. Get rewarded with an annual $149 rebate and $10 monthly for overdraft protection.

5. Online Banking: Seamlessly manage your account online, from checking balances to transferring funds and paying bills.

6. Credit Card Processing: Unlock the ability to accept credit card payments from your customers with TD’s credit card processing service.

Pricing:

1. Monthly Fee Waiver: You can maintain a minimum balance of $65,000 throughout the month to waive the $125 monthly fee.

2. Cash Deposits: Deposits exceeding $25,000 per month incur an additional $2.50 charge per $1,000.

8. KOHO Business Account

Another one for you, for businesses seeking a streamlined and efficient banking solution, the KOHO Business Account is the digital answer to your needs. This account offers a suite of features that simplify the management of your business finances.

Another one for you, for businesses seeking a streamlined and efficient banking solution, the KOHO Business Account is the digital answer to your needs. This account offers a suite of features that simplify the management of your business finances.

The KOHO Business Account combines affordability, convenience, and rewards to provide an ideal banking solution for modern businesses.

Benefits:

1. Cost-Efficient Banking: Say goodbye to fees. The KOHO Business Account boasts a no-fee structure, encompassing monthly fees, transaction fees, and foreign exchange fees. This ensures you save substantially on banking expenses.

2. Easy Account Management: Seamlessly oversee your account using the user-friendly KOHO app. Monitor your balance, transfer funds, and make payments with utmost convenience.

3. Cashback Rewards: Earn cashback rewards on select purchases, turning everyday expenses into potential revenue for your business.

4. Integration with Third-party Apps: Enjoy enhanced financial management by integrating the account with various third-party apps, streamlining your business operations.

9. CIBC Everyday Business Operating Account

The CIBC Everyday Business Operating Account caters to small businesses, offering both self-service and full-service options with associated fees. Here’s what you need to know:

The CIBC Everyday Business Operating Account caters to small businesses, offering both self-service and full-service options with associated fees. Here’s what you need to know:

Benefits:

1. No Minimum Balance Requirement: Unlike many other accounts, there’s no stringent minimum balance requirement. You can open an account with any amount over $500K and still earn interest on your savings.

2. Easy Account Management: Seamlessly manage your account online. You can check your balance, transfer funds, and make withdrawals with ease.

3. Competitive Interest Rates: The account offers tiered interest rates, rewarding higher balances with better rates.

Pricing:

1. Monthly Fees: There’s a $20 monthly fee for self-service access and a $25 monthly fee for full-service support. However, maintaining a daily balance of at least $15,000 waives these fees.

2. Transaction Costs: Additional transactions cost between $1.00 and $1.25 each.

3. Statements: Printed statements are available at a cost of $3.50 each.

4. Cash and Coin Deposits: Depositing cash ranges from $2.25 to $2.50 per $1,000, while coin deposits incur a fee of $2.50 per $100.

10. CIBC Unlimited Business Operating Account:

If your business handles low volumes of cash deposits, the CIBC Unlimited Business Operating Account is a top contender. Priced at $65 per month, it offers a cost-effective solution for your business chequing needs. Here’s why it could be the perfect fit for you:

If your business handles low volumes of cash deposits, the CIBC Unlimited Business Operating Account is a top contender. Priced at $65 per month, it offers a cost-effective solution for your business chequing needs. Here’s why it could be the perfect fit for you:

Benefits

1. Unlimited Electronic Transactions: Enjoy limitless electronic transactions, including Interac e-transfers, bill payments, and pre-authorized debits, all under a fixed monthly fee.

2. Low-Fee Transactions: This account boasts low fees for online transactions, particularly with Interac e-Transfers, making managing your business finances easy on your budget.

3. Overdraft Protection: You’re safeguarded from additional fees and penalties with included overdraft protection.

Pricing

Paper Statement: A nominal charge of $3.50 is applicable for every paper statement.

Cash Deposits: Beyond the monthly limit of $15,000, a fee of $2.50 per $1,000 will be applied to cash deposits.

11. Scotiabank Unlimited Account:

For businesses dealing with high volumes of cash deposits, the Scotiabank Unlimited Account reigns supreme. Tailored for cash-intensive operations, this account offers a host of benefits, making it a standout choice:

For businesses dealing with high volumes of cash deposits, the Scotiabank Unlimited Account reigns supreme. Tailored for cash-intensive operations, this account offers a host of benefits, making it a standout choice:

Benefits

1. Unlimited Transactions: Enjoy the freedom of unlimited free transactions, including electronic and in-branch transactions.

2. High-Volume Cash Deposits: What sets this account apart is its ability to handle up to $30,000 in cash deposits each month, surpassing other business accounts.

3. Special Use Software: Scotiabank provides software to streamline financial management, saving businesses money on other expenses.

4. Convenient Online Banking: Manage your account online effortlessly, from checking balances to transferring funds and paying bills.

5. Credit Card Processing: Access a credit card processing service, enabling your business to accept credit card payments from customers.

Pricing

1. Account Options: The plan offers four different options: Plan A, Plan B, Plan C, and Unlimited.

2. Monthly Fee Waiver: You can avoid the $120 monthly fee for the Unlimited option by maintaining a minimum daily balance of $75,000.

3. Cash Deposits: While businesses can deposit up to $30,000, for every additional $1,000, a $2.50 fee is applied.

The 15- Best Business Bank Account Canada For You- 2023

- Alright, you are starting or currently running a business in Canada? Then you must have a dedicated business account. And not just any account – knowing the BEST one for your business is essential.

- Unlike personal bank accounts, business accounts in Canada have their own nuances. That’s why it’s crucial to understand which account is the perfect fit for your unique business.

- In this comprehensive guide, we’ll walk you through the different types of business accounts available in Canada. We’ll explore their advantages and disadvantages, and also provide valuable insights on other important aspects of opening an account in Canada.

BEST CANADIAN BANK FOR SMALL BUSINESS

Small businesses in Canada are legally required to maintain a dedicated business account. Hence, the hunt for the ideal bank that suits your small business’s needs becomes crucial. Canada offers a variety of banks providing tailored business account solutions, ensuring you find the perfect fit for your enterprise.

In this comprehensive guide, we will delve into the top banks offering the most advantageous business accounts for small businesses in Canada.

We will also explore the key considerations to weigh when selecting the right bank to kickstart your small business account.

Things To Consider Before Choosing a Bank For Your Small Business

When you’re setting up a bank account for your small business in Canada, it’s crucial to pick the right bank that suits your business requirements. Here are some key factors to keep in mind when selecting a bank for your small business account:

· Bonuses

· Insurance safety

· Interest rates

· Account Fees

· Bank Misleading Promotions

Bonuses

Cash incentives and free services are just some of the bonuses offered by banks to attract new business customers. But before you sign up, make sure you understand the terms and conditions.

Some banks might ask you to keep a minimum balance or complete a certain number of transactions to qualify for the bonus. Remember, while bonuses are great, it’s important to consider the long-term benefits before making your decision.

Insurance Safety

When you entrust your funds to a bank, safeguarding your hard-earned money becomes paramount. Rest assured, the Federal Deposit Insurance Corporation (FDIC) steps in to insure deposits in the majority of banks up to $250,000. That means, even if a bank were to fail, you’ll be reimbursed for your deposit, up to a specific limit.

Ensuring your chosen bank is FDIC-insured is absolutely crucial. By doing so, you can enjoy ultimate peace of mind knowing that your deposits are shielded from any potential mishaps.

Interest Rates

When it comes to securing a loan or a line of credit for your business, interest rates hold the key. These rates determine the amount you’ll be shelling out to fulfill your financial requirements, and they can diverge significantly depending on the banking institution and the loan type.

To ensure you’re maximizing your savings, it’s essential to compare interest rates across loans, lines of credit, and savings accounts from various banks. By doing so, you can secure the most competitive rates available.

A lower interest rate not only puts more money back in your pocket over time but also facilitates a smoother journey toward debt repayment.

Account Fees

Choosing the right bank can make a big difference to your finances. But with so many fees to consider, how do you find the best bank for you?

Discover the fees that banks commonly charge, such as monthly maintenance fees, ATM fees, transaction fees, overdraft fees, and wire transfer fees. However, don’t forget that some banks may waive certain fees depending on factors like your account balance.

When it comes to saving money and maximizing your profits, selecting a bank with lower fees is key. Make an informed decision by comparing and researching the fees charged by different banks. Find out the conditions for waiving fees and how they can benefit you.

Bank Misleading Promotions

Don’t be swayed by banks that resort to dishonest promotions to attract customers. These deceptive tactics may involve misleading terms, false guarantees of low rates or high profits, and undisclosed fees.

To avoid falling into these traps, always make it a habit to carefully read the fine print and thoroughly research before making any decisions. Remember, choosing a bank solely based on promotional offers could result in long-lasting headaches and financial setbacks.

Best Banks For Small Businesses In Canada

Let’s discover Canada’s thriving banking sector, offering a wide array of services specifically designed for small businesses. With numerous options available, let’s find out which banks are the ultimate choices for your business operations.

12. CIBC Unlimited Business Accounts

CIBC, one of Canada’s largest banks, is a top choice for small businesses. With a wide range of features and benefits tailored to their unique needs, CIBC provides flexible account options, competitive fees, and access to various financial products and services.

Flexibility is key when it comes to CIBC’s Unlimited Business Account. For just $65 per month, small business owners can enjoy a wide range of account types to suit their specific requirements. Alternatively, the CIBC Everyday Operating Account caters to businesses of all sizes and transaction volumes.

These accounts offer flexible transaction limits for electronic transactions, in-branch transactions, and cheque deposits.

When it comes to fees, CIBC understands that every business is different. That’s why they offer a variety of fee structures to choose from, including low monthly fees and pay-per-use options. This ensures that small businesses only pay for the banking services they use.

In addition to these features, CIBC provides small businesses with access to a comprehensive range of financial products and services. Whether it’s business loans, lines of credit, business credit cards, or cash management services, CIBC has it all. They also offer a wealth of resources, including educational materials, business planning tools, and personalized advice from their team of business advisors.

And here’s the best part: small business owners can enjoy all these benefits at no cost if they maintain a minimum balance of $45,000 in their account. This covers debit and credit transactions, as well as up to 100 checks per month. Additional perks, such as paper statements and cash deposits, come with small fees but offer great convenience.

13. Tangerine Bank

When it comes to managing finances, Tangerine Bank is the go-to choice for small businesses in Canada. With an array of features and benefits catered specifically to small businesses, Tangerine Bank makes financial management a breeze.

One of the standout advantages of Tangerine Bank is its commitment to low fees. Operating on a tight budget? Not a problem. Tangerine Bank offers business banking services with no monthly fees or minimum balance requirements, ensuring that your banking costs stay low and affordable.

But that’s not all. Tangerine Bank takes convenience to the next level with its range of digital banking services. With mobile banking, online bill payment, and e-statements, managing your finances becomes a seamless experience.

Small businesses, constantly on the move, will find this particularly helpful as they can easily stay on top of their finances anytime, anywhere.

14. National Bank of Canada

The National Bank of Canada (NBC), the go-to choice for small businesses seeking tailored banking solutions. With a variety of account options, including the Business Current Account and the Business Advantage Account, NBC caters to the unique needs of small businesses with flexible transaction limits, competitive fees, and a wealth of additional benefits.

The National Bank of Canada (NBC), the go-to choice for small businesses seeking tailored banking solutions. With a variety of account options, including the Business Current Account and the Business Advantage Account, NBC caters to the unique needs of small businesses with flexible transaction limits, competitive fees, and a wealth of additional benefits.

One standout feature is NBC’s competitive fee structure, designed to accommodate different business needs. Whether you prefer low monthly fees or a pay-per-use model, NBC allows you to choose the fee structure that aligns perfectly with your requirements. You no longer worry about paying for unused services and only pay for what you use.

On top of that, NBC provides small businesses with a comprehensive range of financial products and services. From business loans and lines of credit to cash management services, NBC has you covered.

You can also manage your finances on the go with the mobile banking app, enabling you to check account balances, transfer funds, and pay bills straight from your mobile device. Streamlining your financial workflows and reducing administrative overhead with online banking tools like e-statements and online bill payment has become seamless with the National Bank of Canada

The National Bank Business Package 100 offers up to 100 monthly transactions. Priced at just $77.99 per month, this package also allows you to deposit up to $15,000 in cash, $500 in coins, and up to 60 cheques every month.

15. Wise Business Account

Have you heard of Wise? It’s the new name for TransferWise, and it’s the ultimate banking solution for small businesses involved in international transactions. Let’s talk about why it’s such a hit.

Wise knows small businesses need every dollar to count. That’s why they offer incredibly low fees and crystal-clear exchange rates. Now, hidden charges and hello to savings on foreign exchange fees are no longer a worry

Managing your finances is a breeze with Wise. Their online platform is super user-friendly. You can send and receive payments in multiple currencies, set up recurring payments, and track real-time transaction history—all in one place.

They throw in a multi-currency debit card, and here’s the kicker—it’s free of additional fees. Use it for purchases or withdraw cash in multiple currencies without a hitch.

You can also streamline your financial tasks with Wise’s array of APIs and integrations. They’ll help you cut down on administrative work and save precious time.

You may now have a question like, How do I start with international banking? Wise makes it easy with a one-time fee of just $42. No complicated processes here.

When you now exchange currency with Wise, you definitely get the best mid-market rate. That means more value for your money.

So, if your small business is all about global transactions, Wise is the savvy choice for you. Low fees, user-friendly tools, a multi-currency debit card, seamless integrations, straightforward setup, and unbeatable exchange rates—it’s got it all!

16. Scotiabank Basic Business Account

Scotiabank is recognized as a leading bank for small businesses in Canada, offering an extensive array of specialized banking services tailored to cater to their unique requirements. Of their many offerings, the Scotiabank Basic Business Account stands out as a popular choice among small businesses with low monthly transaction volumes, providing a hassle-free and cost-effective solution.

The Scotiabank Basic Business Account boasts unlimited electronic transactions, encompassing online banking, mobile banking, and Automated Banking Machine (ABM) transactions. The account is accompanied by a debit card, facilitating convenient access to funds and cash withdrawals at any ABM.

Notably, the Scotiabank Basic Business Account stands out with its incredibly low monthly fee of just $6.99. This makes it an appealing option for small businesses that do not engage in high volumes of monthly transactions, yet still require access to essential banking services.

It is important to note that there may be additional fees associated with in-branch transactions and cash deposits, so it is advisable to review the fee schedule thoroughly to ensure it aligns with your specific business needs.

Moreover, the Scotiabank Basic Business Account offers seamless integration with other Scotiabank business services, including merchant services and credit card processing. This integration simplifies financial management for small businesses by consolidating their banking needs into a single, easily accessible platform.

Apart from banking services, Scotiabank extends a range of supplementary resources and services targeted at assisting small businesses. These include business loans, lines of credit, and cash management solutions. Additionally, they provide access to dedicated business advisors who offer personalized guidance and support to drive growth and success for small businesses.

The Scotiabank Basic Business Account is available in both Canadian and US dollars. By maintaining a minimum daily closing balance of $8,000 throughout the month, you can even waive the $10.95 monthly fee. Furthermore, for every $1,500 held in your account, you will receive one free transaction per month.

It is important to consider the costs associated with this account. Each additional debit purchase will be charged a fee of $1.25, while cash deposits will incur a fee of $2.50 per $1,000 deposited. Coin deposits will also be subject to a fee of $2.50 per $100 deposited.

In conclusion, if you are an existing Scotiabank customer and maintain a substantial account balance, the Basic Business Account could prove advantageous for you.

17. TD Basic Business Plan

The TD Basic Business Plan is a popular banking option designed for small businesses in Canada. It provides a wide range of properties and advantages tailored to meet the unique needs of small businesses. These include flexible transaction limits, competitive fees, and access to TD’s extensive network of branches and ATMs.

One of the primary advantages of the TD Basic Business Plan is its flexibility. It allows small businesses to select from various transaction options, such as electronic transactions, in-branch transactions, and cheque deposits. This adaptable feature ensures that small businesses have access to the required banking services, regardless of their preferred transaction method.

Additionally, the TD Basic Business Plan offers competitive fees. For a monthly fee of $5.00, small businesses receive a set number of electronic transactions and in-branch transactions. Additional transactions can be added at a reasonable cost, making it an affordable choice for small businesses with moderate to high transaction volumes.

Furthermore, the TD Basic Business Plan provides small businesses with convenient access to TD’s extensive network of branches and ATMs. This is especially crucial for businesses that require in-person banking services, such as cash deposits or withdrawals. With TD’s widespread presence throughout Canada, small businesses can easily access banking services from almost anywhere.

And it is specifically designed for small businesses with minimal monthly transactions and includes a complimentary TD Business Savings Account.

Pricing

This service comes with a monthly fee of $5, which includes five complimentary transactions and five free deposits, encompassing both cheques and money orders. If you surpass the free transaction limit, there will be an extra charge of $1.25 for each additional transaction. As for additional deposits, there’s a fee of $0.22 per deposit. Additionally, cash deposits will incur a charge of $2.50 for every $1,000 deposited.

The 15- Best Business Bank Account Canada For You- 2023

- Alright, you are starting or currently running a business in Canada? Then you must have a dedicated business account. And not just any account – knowing the BEST one for your business is essential.

- Unlike personal bank accounts, business accounts in Canada have their own nuances. That’s why it’s crucial to understand which account is the perfect fit for your unique business.

- In this comprehensive guide, we’ll walk you through the different types of business accounts available in Canada. We’ll explore their advantages and disadvantages, and also provide valuable insights on other important aspects of opening an account in Canada.

Frequently Asked Questions

Can I open a business account in a foreign currency with Wise?

Yes, Wise offers multi-currency accounts, allowing you to hold and manage funds in various currencies. This is beneficial for businesses that engage in international trade or have operations in different countries

What are the required documents for opening a business bank account?

To open a business account, you will need the following documents: proof of identity (government ID), proof of full name and address, and your social insurance number. These requirements apply to all business types. Additionally, depending on your specific business type, you may also need the following documents: trade name registration certificate or master business license, registered declaration of partnership, trade name registration certificate, and Canada Revenue Agency registration number.

Which bank offers the best business account?

The best business account for your needs would be the one that provides you with reasonable pricing and features tailored to your business requirements.

Is it possible to have multiple business bank accounts?

Yes, you can open as many business accounts as necessary to accommodate the needs of your business. However, it is recommended to open a limited number of accounts for better management of your business finances.

Which bank is the most suitable for a startup business in Canada?

There are multiple business account providers in Canada, including Scotiabank Basic Business Account, TD Basic Business Plan, Wise Business Account, and Canadian Imperial Bank of Commerce.

What type of bank account do small businesses need?

Small business owners should open a business account once they begin to receive payments for goods or services provided. With a business account, small businesses can also make payments at reduced rates.

How do I open a small business bank account in Canada?

The specific documents required to open a small business bank account in Canada will depend on your business type. These documents may include articles of incorporation/association, certificate of status, certificate of existence, certificate of compliance, corporate profile report, corporate annual government filing, business number, and business license.

Benefits of Opening a Business Bank Account:

- Convenient management of business finances without the need to visit a physical bank branch.

- Access to online banking tools, such as mobile banking, online bill payment, and e-statements, for convenient financial management on the go.

- Potential access to reduced fees, depending on the chosen bank from the provided list.

- You can benefit from other services offered by some business banks such as merchant services agreement discounts or merchant cash advance programs that may be beneficial for small businesses with tight budgets looking for financing options

Drawbacks of Opening a Business Bank Account:

- Small businesses may incur substantial expenses due to the requirement of maintaining a minimum balance to establish and sustain the account.

- Depending on the chosen bank, additional charges may arise such as fees for various services including merchant services or cash advances.

- It is crucial to thoroughly review the terms and conditions of the business banking agreement prior to enrolling for an account to ensure awareness of any extra fees or limitations associated with it.

- Every bank differs in terms of customer service and expertise, therefore it is essential to opt for a bank experienced in assisting small businesses like yours, as may be required in future scenarios.

Conclusion

Businesses operate on a customized basis, as each one requires an account type that aligns with their specific operations. These banks offer top-notch services to assist small businesses in expanding their reach and achieving financial inclusivity.

Over the years, Canadian banks have consistently supported the growth and prosperity of small businesses by providing banking services and financial assistance when needed.

If you currently own a small business in Canada or are planning to start one, any of the aforementioned banks will offer you suitable banking services tailored to your business needs.