Gold is one of the best investments to make as it helps to store value even against inflation. Scotiabank, one of Canada’s largest banks, is one of the best places to get physical gold. Other prominent Canadian banks such as CIBC, RBC, TD, and BMO sell physical gold.

This guide will first look at the gold price Canada Scotiabank. After that, we will examine whether gold is a good investment, how to buy physical golf in Canada, the various ways to invest in gold, and factors to consider when investing in physical gold.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

Gold Price Canada Scotiabank

- Gold is one of the best investments to make as it helps to store value even against inflation. Scotiabank, one of Canada’s largest banks, is one of the best places to get physical gold.

- This guide will first look at the gold price Canada Scotiabank. After that, we will examine whether gold is a good investment, how to buy physical golf in Canada, the various ways to invest in gold, and factors to consider when investing in physical gold.

Gold Price Canada Scotiabank

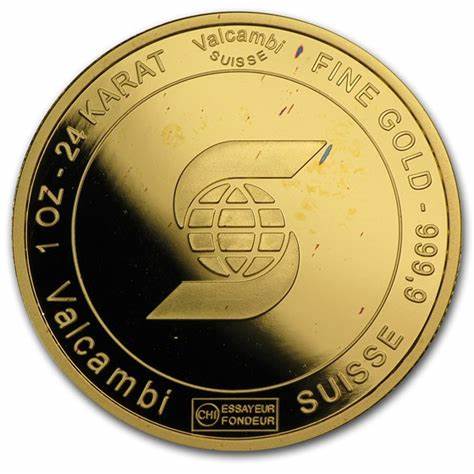

Physical gold comes in bullion bars from Scotiabank. One 1 oz gold Scotiabank bar is made of 99.99% pure gold. The 1 oz pure gold bar from Scotiabank is adorned with the company emblem at the front, and the back contains details of the ounces, assay, and purity. This gold bar is classy and straightforward. You can get it at CA$2,679.75.

The gold process changes according to the state’s economic condition, so it is essential to check Scotiabank’s website to know the updated price. Also, you can contact their customer service for more information on the specific gold products, pricing, and the process for buying or selling gold. Additionally, you can check the Gold Stock Live site for updated prices of gold in Scotiabank.

Is Gold a Good Investment?

Gold has historically been considered a store of value and a hedge against inflation. It is one of the best investment options in modern societies. Gold investments can come in various ways; buying physical gold bars, gold coins, gold jewelry, etc.

Yes, gold is generally considered a good investment, and some points prove it. They are as follows:

Diversification:

Gold can provide diversification benefits to an investment portfolio. It tends to have a low correlation with other asset classes like stocks and bonds. Adding gold to a diversified portfolio may help reduce overall risk.

Hedge against inflation:

Gold is often viewed as a hedge against inflation. During periods of high inflation, the value of paper currencies can erode, and investors may turn to gold as a store of value. For instance, the overall stock market came down by 33% during the 2007-2008 bear market, while the value of gold only dropped by 2%.

Safe-haven asset:

Gold is considered a safe-haven asset, meaning it tends to hold its value or even appreciate during economic and political uncertainty. It can provide stability and act as a form of insurance during turbulent times.

Long-term performance:

Over the long term, gold has shown a relatively stable, albeit modest, rate of return. However, it’s important to note that gold prices can be volatile in the short term and are influenced by various factors, such as economic conditions, interest rates, geopolitical events, and investor sentiment.

Costs and liquidity:

Investing in physical gold, such as gold bars or coins, may involve costs for storage, insurance, and authentication. On the other hand, gold ETFs or mutual funds provide a more convenient way to invest in gold without physical ownership. These investment vehicles offer liquidity and are traded on major exchanges.

How to Buy Physical Gold in Canada

Physical gold is one of the best ways to invest in gold. To buy physical gold in Canada, you have a few options:

Banks

In Canada, you can purchase gold directly from any big five banks, such as Scotiabank, BMO, RBC, CIBC, and TD, through online banking, your bank account, or in-person at a branch.

However, there is a limit of gold you can purchase from any of Canada’s major banks within 24 hours, and it usually caps around $10,000. If you want to buy more than $10,000 worth of gold, you must do that in person at your local branch and come with two pieces of ID.

TD places even lower limits on the value of gold a non-bank customer can purchase within 24 hours, and this limit is capped at $2,999.99.

Precious Metal Dealers

There are specialized precious metal dealers across Canada that sell gold bullion products. These dealers often offer various options, including different sizes of gold bars and various gold coins. You can search for reputable dealers in your area or consider well-known national dealers.

Online Retailers

Many online retailers and marketplaces allow you to buy gold bullion online and deliver it to your doorstep. These platforms provide a convenient way to purchase gold, especially if you don’t have easy access to physical dealers in your area. Ensure that you choose reputable and trusted online retailers.

The Different Ways to Invest in Gold

Apart from physical gold bullion bars, you can invest in gold in other ways. Here are some of the ways:

Gold Coins

The Royal Canadian Mint (RCM) is the primary producer of gold coins in Canada. The RCM offers a variety of gold coins that are recognized and trusted worldwide. Here are some popular gold coin options available in Canada:

- Gold Maple Leaf: The Gold Maple Leaf is one of the most well-known and widely traded gold coins globally. The Royal Canadian Mint produces it and features the iconic maple leaf design on the reverse side. The coin comes in various sizes, including 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz.

- Gold Call of the Wild Series: This is a series of gold coins issued by the Royal Canadian Mint that features wildlife-themed designs. Each coin in the series highlights a different Canadian animal, such as the Howling Wolf, Roaring Grizzly, or Bugling Elk. These coins are available in various weights, including 1 oz and fractional sizes.

- Gold Canadian Wildlife Series: The Canadian Wildlife Series is a previous coin series from the Royal Canadian Mint. It consists of gold coins featuring various Canadian wildlife designs, including animals like Moose, Cougar, and Bison. These coins are no longer in production but can still be found in the secondary market.

When purchasing gold coins, buying from reputable dealers or directly from the Royal Canadian Mint is essential to ensure their authenticity and quality. When selecting, consider factors such as the coin’s purity, weight, and the current market price of gold. Also, collector coins may have a higher premium due to their rarity or unique features.

Gold Price Canada Scotiabank

- Gold is one of the best investments to make as it helps to store value even against inflation. Scotiabank, one of Canada’s largest banks, is one of the best places to get physical gold.

- This guide will first look at the gold price Canada Scotiabank. After that, we will examine whether gold is a good investment, how to buy physical golf in Canada, the various ways to invest in gold, and factors to consider when investing in physical gold.

Gold Jewelry in Canada

You can find gold jewelry in Canada at various jewelry stores, department stores, and online retailers. Gold jewelry serves a double function as a fashion accessory and investment. Gold jewelry comes in different forms, including necklaces, bracelets, earrings, rings, and more.

When shopping for gold jewelry, consider the following:

- Purity: Gold jewelry is typically measured in karats (kt) to indicate purity. Pure gold is 24kt, but it is too soft for jewelry, so it is often alloyed with other metals to enhance durability. Common purities for gold jewelry in Canada are 10kt, 14kt, 18kt, and 22kt. The higher the karat, the higher the gold content and, typically, the higher the price.

- Price: The price of gold jewelry can vary depending on factors such as the karat weight, design intricacy, craftsmanship, and brand. Compare prices from different retailers to ensure you’re getting a fair deal. It’s worth noting that jewelry prices also include the cost of design and craftsmanship, which may differ from the actual value of the gold content.

- Trustworthy Retailers: Choose reputable and trusted retailers or jewelers when buying gold jewelry. Look for establishments with a good reputation, positive customer reviews, and a commitment to quality and customer service.

- Certification: Consider looking for jewelry with certifications or hallmarks that verify the gold content and authenticity. These certifications can assure the quality and value of the piece and can be helpful if you want to store it as value or resale it later.

- Return Policy and Warranty: Before making a purchase, understand the retailer’s return policy and any warranty or guarantee they offer for the jewelry. This ensures you have recourse if there are any issues or if you change your mind.

Gold Mines Stocks

Another reputable way to invest in gold is by investing in stocks of gold mining companies in Canada, as they provide entrance to the country’s vibrant gold mining industry. Here are some notable gold mining companies in Canada that you may consider researching when looking to invest in stocks of gold mines:

- Barrick Gold Corporation (ABX.TO): Barrick Gold is one of the largest gold mining companies globally, with operations and projects in various countries, including Canada. It owns and operates several gold mines in Canada, such as Hemlo in Ontario and Williams Mine in British Columbia.

- Newmont Corporation (NGT.TO): Newmont is another leading gold mining company with global operations, including assets in Canada. It has an ownership stake in the Canadian Malartic mine in Quebec, one of Canada’s largest producing gold mines.

- Agnico Eagle Mines Limited (AEM.TO): Agnico Eagle is a Canadian-based gold mining company with mines located primarily in Canada, Finland, and Mexico. The company operates mines in Canada, such as the LaRonde Complex in Quebec and the Meadowbank Complex in Nunavut.

Others include:

- Kinross Gold Corporation (K.TO)

- Yamana Gold Inc.

Gold Mutual Funds and ETFs

Investing in gold mutual funds and exchange-traded funds (ETFs) in Canada is a popular way to gain exposure to the price movement of gold without directly owning physical gold. Most of them are listed on the Toronto Stock Exchange (TSX). Notable gold mutual funds and ETFs available in Canada are:

- iShares Gold Bullion ETF (CGL.C)

- Horizons Gold ETF (HUG.TO)

- Sprott Physical Gold and Silver Trust (CEF.A.TO)

- BMO Gold ETF (ZGD.TO)

- Purpose Gold Bullion Fund (KILO.TO)

- RBC Global Precious Metals Fund (RBF456)

Futures and Options

You can go into Futures and Options if you are a high-risk investor. Futures and options on gold can be traded on designated commodity exchanges, such as the Montreal Exchange (MX). These derivative contracts allow investors to speculate on the future price movements of gold without directly owning the physical metal.

When trading futures and options on gold, it’s essential to understand derivatives, how it works, and their associated risks. Also, you should be able to analyze the gold market and understand the influence of macroeconomic indicators, supply and demand dynamics, and geopolitical events on the market.

Factors to Consider When Buying Physical Gold

When buying physical gold, there are several important factors to consider. These factors can help you make an informed decision and ensure you get a good value for your investment. Here are some key factors to consider:

- Purity: The purity of gold is measured in karats (kt) or fineness. Pure gold is 24kt, but it is too soft for jewelry or investment purposes, so it is often alloyed with other metals. The purity of gold is crucial as it determines the actual gold content in the item you are buying. For investment purposes, choosing gold with a high purity level is generally recommended, such as 22kt or 24kt.

- Weight: The weight of the gold item is another important factor. It determines the amount of gold you are purchasing. Gold is typically weighed in troy ounces (ozt) or grams. Understanding the weight is essential for calculating the value of gold based on the current market price.

- Premium: The premium is the amount charged above the intrinsic value of the gold content. It covers manufacturing, distribution, and profit margins. Different gold products may have different premiums. Compare premiums from other sellers to ensure you are paying a fair price.

- Authenticity: Ensuring the authenticity of the gold is crucial. Look for reputable sellers who provide proper documentation, such as certificates of authenticity or recognized mint marks. These markings or certifications verify the authenticity and quality of the gold product.

- Storage and Security: Consider how you plan to store and secure your physical gold. Gold can be stored at home securely, in a bank safety deposit box, or with a third-party storage provider. Ensure you have a secure and suitable storage solution protecting your investment.

- Market Conditions: Keep an eye on the overall market conditions and the price of gold. Gold prices can fluctuate due to factors such as economic conditions, interest rates, geopolitical events, and investor sentiment. Understanding the market conditions can help you make better timing decisions.

- Purpose and Investment Goals: Clarify your purpose and investment goals for buying physical gold. Are you looking for a long-term investment, a hedge against inflation, or a collectible item? Your goals and timeframe will influence the type of gold product you choose and the amount you invest.

Gold Price Canada Scotiabank

- Gold is one of the best investments to make as it helps to store value even against inflation. Scotiabank, one of Canada’s largest banks, is one of the best places to get physical gold.

- This guide will first look at the gold price Canada Scotiabank. After that, we will examine whether gold is a good investment, how to buy physical golf in Canada, the various ways to invest in gold, and factors to consider when investing in physical gold.

Conclusion

Gold is a good investment, and Scotiabank remains one of the best banks to purchase pure gold bars from. You must confirm the price of the gold before purchasing. You can always check the Scotiabank official website to get the updated price.