When it comes to growing your savings, the account you choose can make all the difference. Whether you’re setting aside money for a future goal or just trying to make your cash work harder for you, finding the best savings account in Canada is essential. With so many options—each boasting high interest rates, zero fees, or easy access to funds—it can be overwhelming to pick the right one.

In this guide, we’ll break down the top Canadian savings accounts of 2024, helping you discover which one best fits your needs. From high-interest options to no-fee accounts, you’ll get a clear picture of what’s available so you can start making your money grow smarter. Ready to find the perfect place for your savings? Let’s dive in!

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

13 Best Savings Account Canada 2024

- When it comes to growing your savings, the account you choose can make all the difference.

- Whether you’re setting aside money for a future goal or just trying to make your cash work harder for you, finding the best savings account in Canada is essential.

- In this guide, we’ll break down the top Canadian savings accounts of 2024, helping you discover which one best fits your needs.

How to Choose the Best Savings Account in Canada for Your Needs

1. Minimum Deposit Requirements: Is This Account Right for Your Budget?

Some savings accounts require a minimum deposit to open or maintain the account. If you’re just starting out or building your savings gradually, an account with no minimum deposit can give you more flexibility. Be sure to check this before committing, especially if you don’t have a large amount of savings ready to go.

2. Reputation Matters: How to Pick a Trusted Bank or Financial Institution

You want to feel confident that your money is safe. Research the bank’s reputation by checking customer reviews and expert ratings. A bank with a strong reputation for customer service, transparency, and financial stability is more likely to meet your expectations. A little homework now can save you from headaches later on.

3. Security Features: Protecting Your Hard-Earned Savings

Your savings need to be secure, so don’t overlook what security measures the bank has in place. Look for things like two-factor authentication, fraud protection, and deposit insurance (like CDIC insurance in Canada). Choosing a bank with strong security measures can give you peace of mind that your money is well-protected.

4. Interest Rates: Maximizing Your Savings Growth

The interest rate is one of the biggest factors to consider when choosing a savings account. Higher interest rates help your money grow faster, but watch out for temporary promotions that might drop after a few months. Be sure to compare regular rates and go for an account that balances a good rate with long-term value.

5. Service Fees: Avoid Getting Nickel-and-Dimed

Service fees can quietly eat into your savings, so it’s important to check the fine print. Some accounts offer no monthly fees but may charge for things like withdrawals or transfers. Make sure the account you choose aligns with your habits, whether it’s making regular deposits or occasional withdrawals, and doesn’t surprise you with extra fees.

Top High-Interest Savings Accounts in Canada for 2024

When it comes to finding the best savings account, it’s all about making sure your money works for you. With so many options available in Canada, you’ll want to compare interest rates, fees, and flexibility before making a decision.

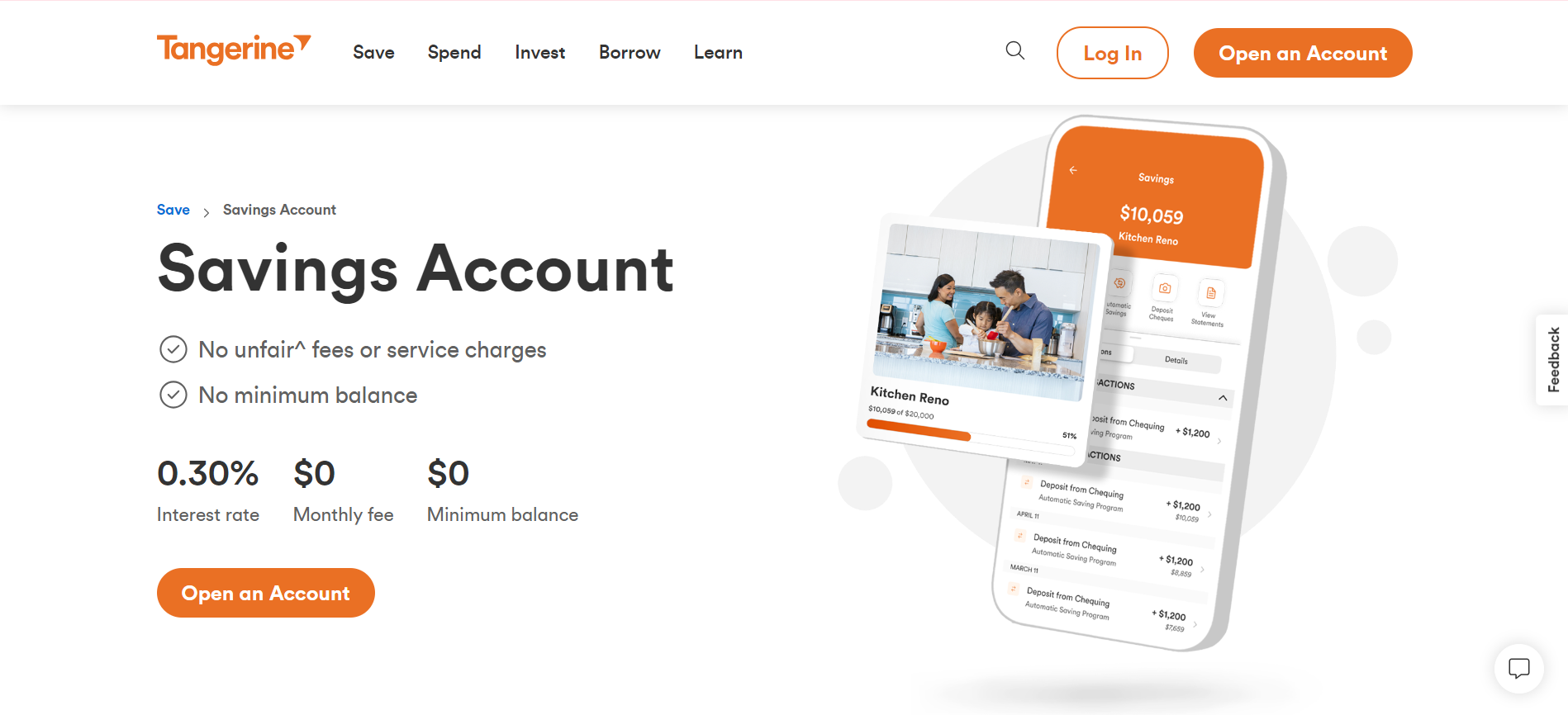

Tangerine Savings Account

If you’re considering the Tangerine Savings Account, you’re looking at a solid, straightforward option to grow your money without unnecessary headaches. This account stands out with its no fees, no minimum balance, and competitive interest rates, making it a great choice if you want to keep things simple and accessible.

You’ll appreciate the current promotional rate of up to 6.00% for new clients for the first 5 months, which gives you a nice boost as you start your savings journey. Once the promotional period ends, you’ll still earn a competitive base rate—though it’s smart to keep an eye on the changes after the promotion.

What’s great about Tangerine is that it’s entirely digital-first, meaning you can manage your account easily from their mobile app or browser. This is especially handy if you’re someone who likes to track your finances on the go. Plus, there are no service fees for everyday transactions, and with unlimited transfers between your Tangerine and other linked bank accounts, you won’t feel restricted in how you access your funds.

If simplicity, ease of use, and avoiding hidden fees are high on your list, Tangerine might just be your perfect match

- Interest Rate: 6.00% (promotional)

- Monthly Fee: None

- Special Features: Easy online access, no monthly fees, and competitive promotional rates. Great for those who want a solid digital banking experience.

Best Savings Account

Discover the best savings account in canada 2024

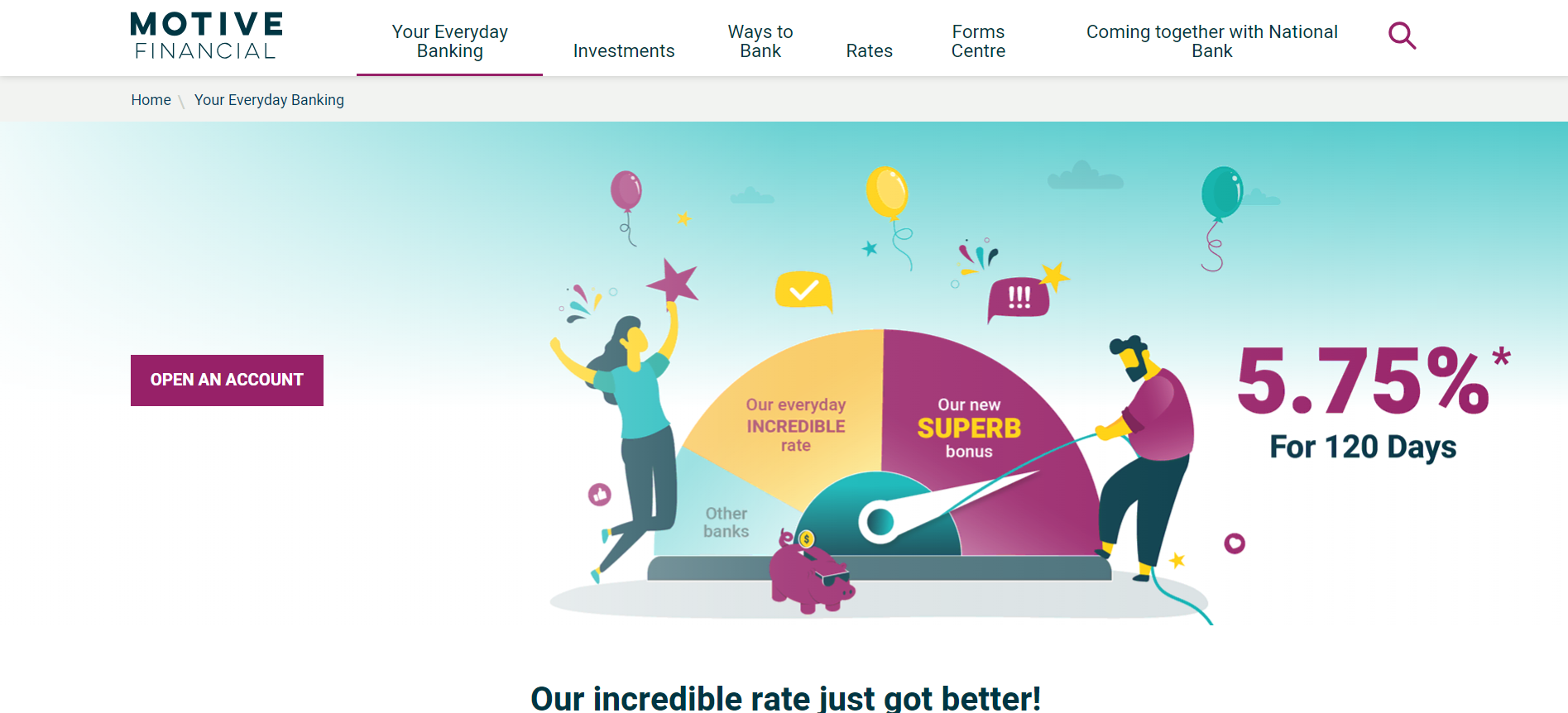

Motive Financial Savvy Savings Account

The Motive Financial Savvy Savings Account is a no-frills, high-interest savings account designed for those who want to maximize their earnings without worrying about fees. Offering a competitive interest rate of 5.75%, this account stands out for having no monthly fees and no minimum balance. It’s perfect if you’re looking for flexibility, as it includes unlimited free transactions and free transfers between your accounts, allowing easy access to your funds whenever you need them. For straightforward, fee-free savings with solid returns, Motive Financial’s Savvy Savings Account is a top choice for Canadians in 2024

The Motive Financial Savvy Savings Account is a no-frills, high-interest savings account designed for those who want to maximize their earnings without worrying about fees. Offering a competitive interest rate of 5.75%, this account stands out for having no monthly fees and no minimum balance. It’s perfect if you’re looking for flexibility, as it includes unlimited free transactions and free transfers between your accounts, allowing easy access to your funds whenever you need them. For straightforward, fee-free savings with solid returns, Motive Financial’s Savvy Savings Account is a top choice for Canadians in 2024

Interest Rate: 5.75%

Monthly Fee: None

Special Features: Offers unlimited free transactions and high interest with no minimum balance. Ideal for people looking to maximize savings without fees.

Neo Financial High-Interest Savings Account

The Neo Financial High-Interest Savings Account offers a solid and straightforward way to grow your savings with a competitive 4.00% interest rate. One of its biggest perks is that it comes with no monthly fees and no minimum balance, making it perfect for savers at any stage. You also get unlimited free transactions, including bill payments, e-Transfers, and transfers to other accounts, giving you full flexibility without worrying about costs. With easy-to-use digital banking features, this account is ideal for those looking for simplicity, flexibility, and a high return on their savings

The Neo Financial High-Interest Savings Account offers a solid and straightforward way to grow your savings with a competitive 4.00% interest rate. One of its biggest perks is that it comes with no monthly fees and no minimum balance, making it perfect for savers at any stage. You also get unlimited free transactions, including bill payments, e-Transfers, and transfers to other accounts, giving you full flexibility without worrying about costs. With easy-to-use digital banking features, this account is ideal for those looking for simplicity, flexibility, and a high return on their savings

Interest Rate: 4.00%

Monthly Fee: None

Special Features: No minimum balance required and unlimited free transactions. A straightforward option for users who want simplicity and flexibility.

WealthONE High-Interest Savings Account

This account offers a competitive interest rate of 4.00%, with no monthly fees or minimum balance requirements. It’s designed to help you grow your savings while enjoying the flexibility of unlimited free transactions, including transfers and bill payments. WealthONE is a fully digital bank, so you can manage your savings easily through their online platform or mobile app.

This account offers a competitive interest rate of 4.00%, with no monthly fees or minimum balance requirements. It’s designed to help you grow your savings while enjoying the flexibility of unlimited free transactions, including transfers and bill payments. WealthONE is a fully digital bank, so you can manage your savings easily through their online platform or mobile app.

WealthONE also provides CDIC insurance, ensuring that your deposits are protected up to the legal limit, giving you peace of mind about the security of your funds. If you’re looking for a straightforward account with solid returns and fee-free services, this is a good option to consider.

Interest Rate: 4.00%

Monthly Fee: None

Special Features: No minimum balance and free transactions. Great for those who want an easy-to-manage account with decent rates and online banking options.

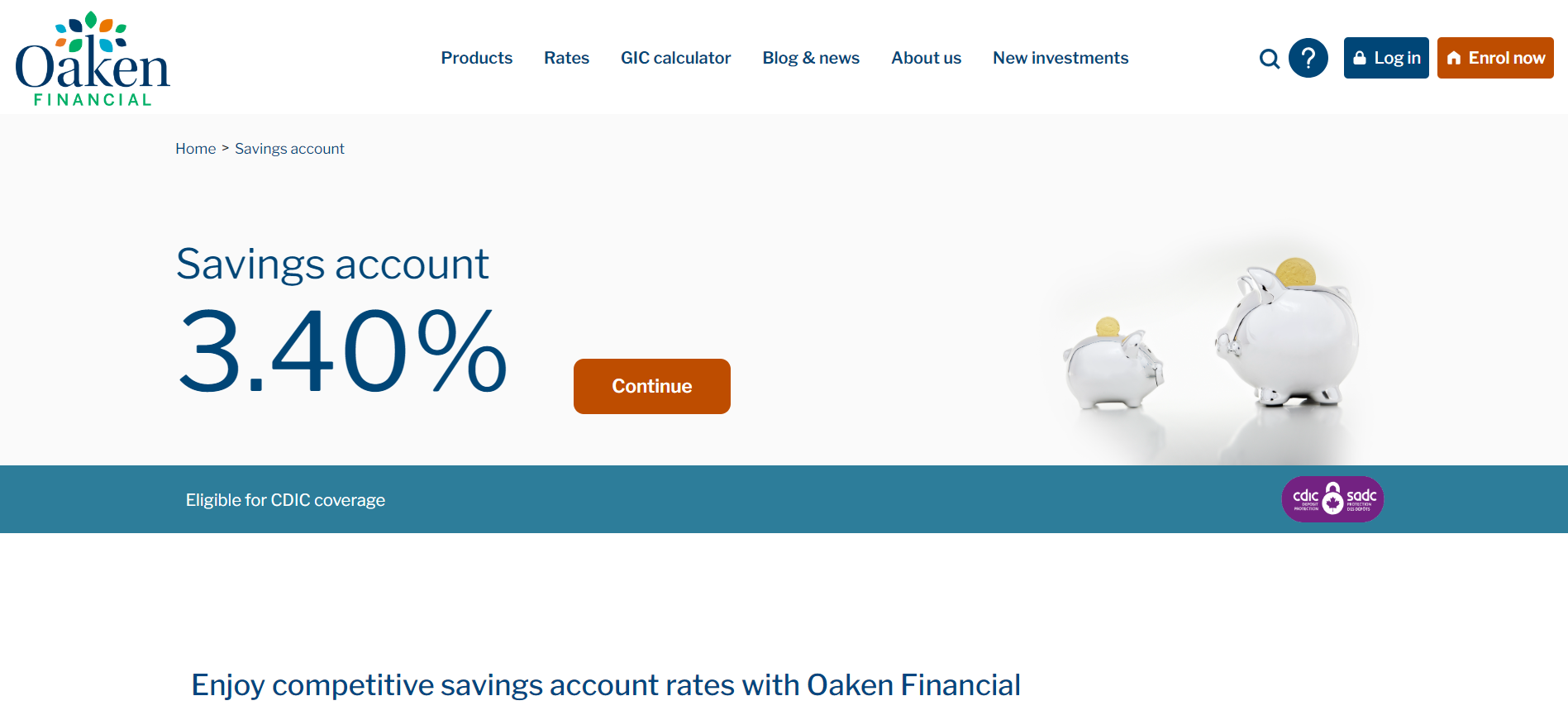

Oaken Financial Savings Account

The Oaken Financial Savings Account is a straightforward, no-frills savings option designed for those who prefer a simple way to grow their money without extra fees or complexities. It offers a competitive interest rate, calculated daily and paid monthly, ensuring that you’re consistently growing your savings. One of the key features is that there are no monthly service fees, which means you won’t be losing your interest gains to maintenance costs.

The Oaken Financial Savings Account is a straightforward, no-frills savings option designed for those who prefer a simple way to grow their money without extra fees or complexities. It offers a competitive interest rate, calculated daily and paid monthly, ensuring that you’re consistently growing your savings. One of the key features is that there are no monthly service fees, which means you won’t be losing your interest gains to maintenance costs.

This account allows for easy online access, letting you manage your funds, track your transactions, and make transfers with ease. You can link external accounts, making it convenient to move money between Oaken and other financial institutions. Additionally, there’s no minimum balance requirement, so you can start saving regardless of your current financial situation.

For those concerned with security, Oaken Financial, a subsidiary of Home Trust Company, provides robust online banking protection, ensuring your deposits are secure. It’s also insured by the CDIC, giving you peace of mind that your savings are protected up to the insured limit.

Overall, if you’re looking for a high-interest savings account with no hidden fees, reliable service, and ease of access, Oaken Financial’s offering is worth considering

Interest Rate: High interest rates compared to competitors

Monthly Fee: None

Special Features: No monthly fees or transfer fees, with easy integration into GICs for long-term savings growth.

13 Best Savings Account Canada 2024

- When it comes to growing your savings, the account you choose can make all the difference.

- Whether you’re setting aside money for a future goal or just trying to make your cash work harder for you, finding the best savings account in Canada is essential.

- In this guide, we’ll break down the top Canadian savings accounts of 2024, helping you discover which one best fits your needs.

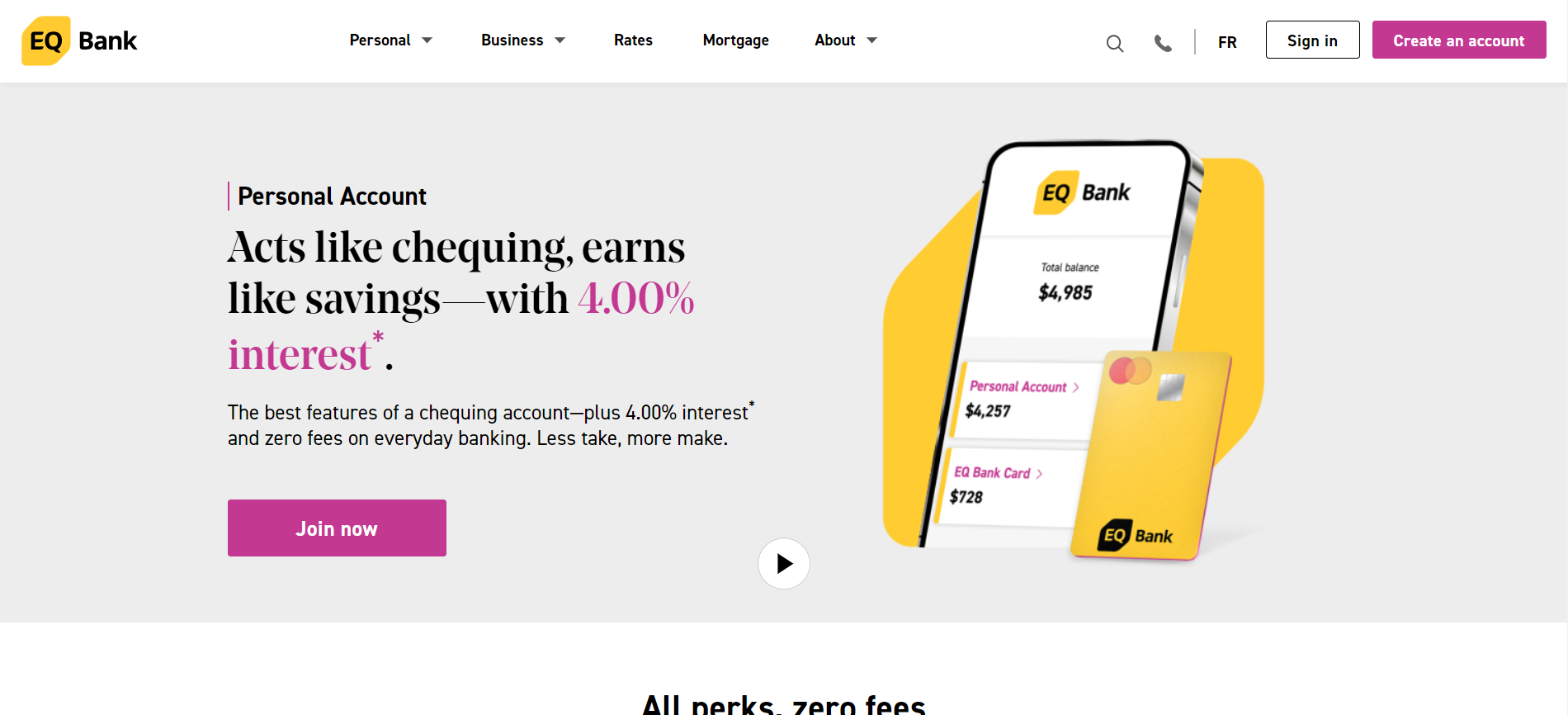

EQ Bank Savings Plus Account

The EQ Bank Savings Plus Account stands out as one of the top online savings accounts in Canada for 2024. With no monthly fees, no minimum balance requirements, and a competitive interest rate of around 2.50%, it provides excellent value. This account works like a hybrid between a savings and chequing account—allowing unlimited free Interac e-Transfers and bill payments while earning you high interest on your deposits.

The EQ Bank Savings Plus Account stands out as one of the top online savings accounts in Canada for 2024. With no monthly fees, no minimum balance requirements, and a competitive interest rate of around 2.50%, it provides excellent value. This account works like a hybrid between a savings and chequing account—allowing unlimited free Interac e-Transfers and bill payments while earning you high interest on your deposits.

You can easily open the account online with just your Social Insurance Number (SIN) and link it to an external bank account for seamless transfers. However, it doesn’t offer ATM access or a debit card, so you’ll need to transfer funds to another account if you need cash.

Security is also top-notch as EQ Bank is insured by the Canada Deposit Insurance Corporation (CDIC), protecting your deposits up to $100,000. This makes it an ideal option for anyone looking to grow their savings in a fully digital environment, as long as you’re comfortable doing your banking online without physical branches

Interest Rate: 2.50%

Monthly Fee: None

Special Features: Free bill payments and transfers, no monthly fees, and a high-interest rate. Ideal for those seeking an all-in-one account for saving and daily banking

Simplii Financial High-Interest Savings Account

The Simplii Financial High-Interest Savings Account is a solid choice for those seeking a straightforward, high-interest option without the hassle of fees. Right now, they’re offering a promotional 6.25% interest rate for the first 5 months on balances up to $1,000,000. This makes it one of the most attractive rates in Canada for a limited time. After the promo period, the regular interest rate reverts to a tiered structure starting at 0.35%.

The Simplii Financial High-Interest Savings Account is a solid choice for those seeking a straightforward, high-interest option without the hassle of fees. Right now, they’re offering a promotional 6.25% interest rate for the first 5 months on balances up to $1,000,000. This makes it one of the most attractive rates in Canada for a limited time. After the promo period, the regular interest rate reverts to a tiered structure starting at 0.35%.

One of the standout features of Simplii’s account is that there are no monthly fees and no minimum balance requirements, which makes it accessible whether you’re starting small or already have a substantial amount saved. Plus, you’ll have access to your account through Simplii’s user-friendly mobile app or online banking portal, letting you manage your funds easily from anywhere.

However, there are a few things to consider before signing up. This is an online-only account, so if you prefer in-person banking, Simplii might not be ideal. Additionally, while you can make transfers and deposits through the mobile app, there are no ATM withdrawal options directly from this savings account.

For those comfortable with digital banking and looking to maximize their savings, especially during the promotion, Simplii Financial’s High-Interest Savings Account offers competitive rates and the security of being backed by CIBC, one of Canada’s Big Five banks

Interest Rate: 6.25% (promotional)

Monthly Fee: None

Special Features: No fees and a high promotional rate make this a standout choice for short-term savings

Best Savings Account

Discover the best savings account in canada 2024

Scotiabank MomentumPLUS Savings AccountThe Scotiabank

MomentumPLUS Savings Account offers a unique structure designed to reward you for keeping your funds saved longer. It combines a regular interest rate with additional premium interest rates, depending on how long you maintain the balance without making withdrawals. You can earn up to 6.00% in total interest for the first 5 months, thanks to promotional offers like a welcome bonus and package interest boosts. After the promotional period, interest rates range from 1.05% for regular interest to up to 1.35% for longer-term premium periods, such as 360 days.

MomentumPLUS Savings Account offers a unique structure designed to reward you for keeping your funds saved longer. It combines a regular interest rate with additional premium interest rates, depending on how long you maintain the balance without making withdrawals. You can earn up to 6.00% in total interest for the first 5 months, thanks to promotional offers like a welcome bonus and package interest boosts. After the promotional period, interest rates range from 1.05% for regular interest to up to 1.35% for longer-term premium periods, such as 360 days.

This account stands out because it doesn’t require a minimum balance, has no monthly fees, and allows unlimited self-service transfers between Scotiabank accounts. However, if you’re looking for everyday banking features, such as automated bill payments or ABM access, this account might not be the best fit.

It’s ideal for those who want to maximize their savings over a longer period without needing to dip into their funds frequently

Interest Rate: Up to 5.75% (promotional)

Monthly Fee: None

Special Features: Bonus interest for keeping your money untouched for set periods. Best for people who don’t need frequent access to their savings

.

Hubert Financial High-Interest Savings Account

Hubert Financial’s High-Interest Savings Account stands out for its simplicity and competitive rates, making it an attractive option if you’re looking to grow your savings quickly. Offering a solid 2.85% interest rate, this account is free of monthly fees and comes with no minimum balance requirements, making it accessible for anyone starting to save. One of the key advantages is that all deposits are fully guaranteed by the Deposit Guarantee Corporation of Manitoba, which means your money is secure regardless of the amount saved.

Hubert Financial’s High-Interest Savings Account stands out for its simplicity and competitive rates, making it an attractive option if you’re looking to grow your savings quickly. Offering a solid 2.85% interest rate, this account is free of monthly fees and comes with no minimum balance requirements, making it accessible for anyone starting to save. One of the key advantages is that all deposits are fully guaranteed by the Deposit Guarantee Corporation of Manitoba, which means your money is secure regardless of the amount saved.

You can easily manage your savings through their user-friendly mobile app, Hubert GO, which allows you to transfer funds, view balances, and more on the go. Plus, Hubert Financial offers U.S. dollar savings accounts, a unique feature that sets them apart from many other Canadian savings accounts.

If you’re searching for an online savings account with competitive rates, no transaction fees, and the peace of mind that comes from a 100% deposit guarantee, Hubert Financial might be a great fit for you.

Interest Rate: Competitive rate (calculated daily)

Monthly Fee: None

Special Features: A straightforward option with interest calculated daily and no monthly fees, perfect for long-term savings goals

.

Achieva Financial High-Interest Savings Account

Achieva Financial’s High-Interest Savings Account offers a solid option for Canadians looking to grow their savings. Backed by Cambrian Credit Union, it provides consistently high interest rates without promotional gimmicks. The interest is calculated on your daily closing balance and paid monthly, and there are no account fees or minimum balance requirements, which means you can start saving regardless of how much you initially deposit.

Achieva Financial’s High-Interest Savings Account offers a solid option for Canadians looking to grow their savings. Backed by Cambrian Credit Union, it provides consistently high interest rates without promotional gimmicks. The interest is calculated on your daily closing balance and paid monthly, and there are no account fees or minimum balance requirements, which means you can start saving regardless of how much you initially deposit.

For those looking to maximize their savings tax-free, Achieva also offers TFSA, RRSP, and RRIF accounts, ensuring flexibility whether you’re saving for short- or long-term goals. You can access your account through Achieva’s user-friendly online and mobile platforms, making banking convenient no matter where you are. Plus, all deposits are fully guaranteed by the Deposit Guarantee Corporation of Manitoba, so your money is secure.

This account is ideal for those who value a no-frills, high-interest option with reliable digital banking features.

Interest Rate: High competitive rates

Monthly Fee: None

Special Features: Allows savings to be diverted into GICs for higher returns, making it a good option for those considering long-term investments

.

Peoples Trust eSavings Account

Peoples Trust eSavings Account offers a solid option for those looking to maximize their savings with a competitive rate and no strings attached. With an interest rate currently at 3.00%, it stands among the higher rates available in Canada. One of its best features is that it charges no monthly fees and has no minimum balance requirement, making it accessible for everyone, whether you’re just starting to save or already have a large sum. The interest is calculated daily and paid monthly, so your money is working for you every day.

What’s more, Peoples Trust is insured by CDIC, which means your deposits are protected up to $100,000, giving you peace of mind knowing your funds are safe. You can easily manage your account online, making transfers between accounts straightforward. However, some users have noted customer service issues, particularly with call center responsiveness, so this might be something to consider if you prioritize fast customer support

Interest Rate: Competitive rates

Monthly Fee: None

Special Features: No minimum deposit and free transfers to other Peoples Trust accounts, making it a good choice for new savers

.

Wyth Financial High-Interest Savings Account

Wyth Financial’s High-Interest Savings Account (HISA) is a competitive option for Canadians looking to grow their savings. With an interest rate that adjusts based on market conditions, it’s currently offering a rate of around 4.00%, which is calculated daily and paid out monthly on balances up to $150,000. This flexibility makes it a great option for those looking to earn more without locking their funds away in a GIC or other fixed-term investment.

One of the standout features of Wyth’s HISA is that it offers these rates with no monthly fees and no minimum balance requirements. It’s a solid choice if you’re looking for a straightforward, fee-free savings option where your money remains accessible. You can easily manage your account online or through their app, though some users have mentioned that the mobile app experience could be improved.

For those wanting transparency and flexibility, Wyth Financial might be worth considering, especially given its secure reputation as a trade name of Concentra Bank, a well-established Canadian financial institution. However, do keep in mind that no interest is paid on amounts exceeding the $150,000 limit, so if you plan to save more than that, you may need to explore other options

Interest Rate: Competitive rates

Monthly Fee: None

Special Features: Easy online management with flexible deposit and transfer options. Good looking for a straightforward savings solution with no monthly fees, no minimum balance for those who want to manage savings digitally

.

13 Best Savings Account Canada 2024

- When it comes to growing your savings, the account you choose can make all the difference.

- Whether you’re setting aside money for a future goal or just trying to make your cash work harder for you, finding the best savings account in Canada is essential.

- In this guide, we’ll break down the top Canadian savings accounts of 2024, helping you discover which one best fits your needs.

Canadian Tire High-Interest Savings Account

The Canadian Tire High-Interest Savings Account (HISA) offers a solid 3.70% interest rate, making it one of the more competitive options in Canada. It’s designed for those requirements, and full CDIC insurance coverage, protecting up to $100,000 per depositor. You can manage your account 24/7 through online banking, which offers flexibility for accessing funds or setting up automatic savings.

One potential downside is that this account lacks e-Transfer capabilities, and the sign-up process involves some paperwork. However, the high rate and the ability to link to external bank accounts for easy transfers make it a strong choice for anyone wanting a hands-off, high-yield savings option

Interest Rate: Competitive interest rates

Monthly Fee: None

Special Features: No minimum balance required and no monthly fees, ideal for those looking for simple, no-hassle savings

Frequently Asked Questions

1. What is a high-interest savings account (HISA)?

A high-interest savings account (HISA) is a type of savings account that offers a higher interest rate than traditional savings accounts. This allows your money to grow faster while still being accessible. Many HISAs are offered by online banks and credit unions, which often have lower overhead costs, enabling them to pass on higher rates to customers

Here are five frequently asked questions (FAQs) related to savings accounts in Canada that can enhance your blog post on the 13 Best Savings Accounts Canada 2024:.

2. How do I choose the best savings account for my needs?

When choosing a savings account, consider factors such as interest rates, minimum deposit requirements, fees, and customer service. It’s also essential to check for insurance coverage on deposits (like CDIC in Canada), the ease of online banking, and whether the account suits your savings goals. Assessing these elements will help you find the right account that fits your financial needs

3. Are savings accounts in Canada insured?

Yes, savings accounts in Canada are typically insured by the Canada Deposit Insurance Corporation (CDIC) for deposits up to $100,000 per account holder, per financial institution. This insurance protects your savings in the event of a bank failure, giving you peace of mind while you save

4. Can I access my money easily with a high-interest savings account?

Most high-interest savings accounts allow easy access to your funds through online banking or mobile apps. However, some accounts may limit the number of withdrawals or transfers per month without incurring fees. Always check the terms and conditions of the account to understand how you can access your money

5. What fees should I watch out for when opening a savings account?

While many high-interest savings accounts come with no monthly fees, it’s essential to look out for potential fees related to withdrawals, electronic fund transfers, or inactivity. Understanding all associated costs will ensure you choose an account that truly fits your financial habits

Best Savings Account

Discover the best savings account in canada 2024

Final Thoughts

In conclusion, selecting the right savings account can significantly impact your financial journey. With the diverse options available in Canada, each tailored to meet different needs and preferences, it’s crucial to assess what matters most to you. Whether you prioritize high interest rates, low fees, or the convenience of online banking, there’s an account that can help you achieve your savings goals.

Take the time to compare features and benefits, and don’t hesitate to switch accounts if you find a better fit down the road. Remember, the best savings account isn’t just about the interest rate; it’s about finding a solution that aligns with your financial habits and aspirations.

With the right account, you’ll not only grow your savings faster but also gain confidence in your financial future. Happy saving!

For more detailed insights into specific accounts, feel free to explore the full reviews and comparisons provided throughout this blog.