If you’ve ever set up direct deposit, pre-authorized payments, or automated withdrawals in Canada, chances are you’ve been asked to provide a void cheque.

But what exactly is a void cheque, and why is it so commonly requested by banks and employers? In this guide, we’ll walk you through everything you need to know about void cheques in Canada—what they are, how to use them, and the easiest ways to get one, even if you don’t have a physical chequebook.

Whether you’re opening a new bank account or setting up bill payments, understanding how void cheques work can save you time and hassle.

Disclosure: My site is reader-supported. I may get commissions when you click through the affiliate links (that are great products I use and stand by) on my articles.

What Is a Void Cheque and How Do You Use It in Canada? A Simple Guide

- If you’ve ever set up direct deposit, pre-authorized payments, or automated withdrawals in Canada, chances are you’ve been asked to provide a void cheque.

- But what exactly is a void cheque, and why is it so commonly requested by banks and employers?

- In this guide, we’ll walk you through everything you need to know about void cheques in Canada—what they are, how to use them, and the easiest ways to get one, even if you don’t have a physical chequebook.

What Is a Void Cheque?

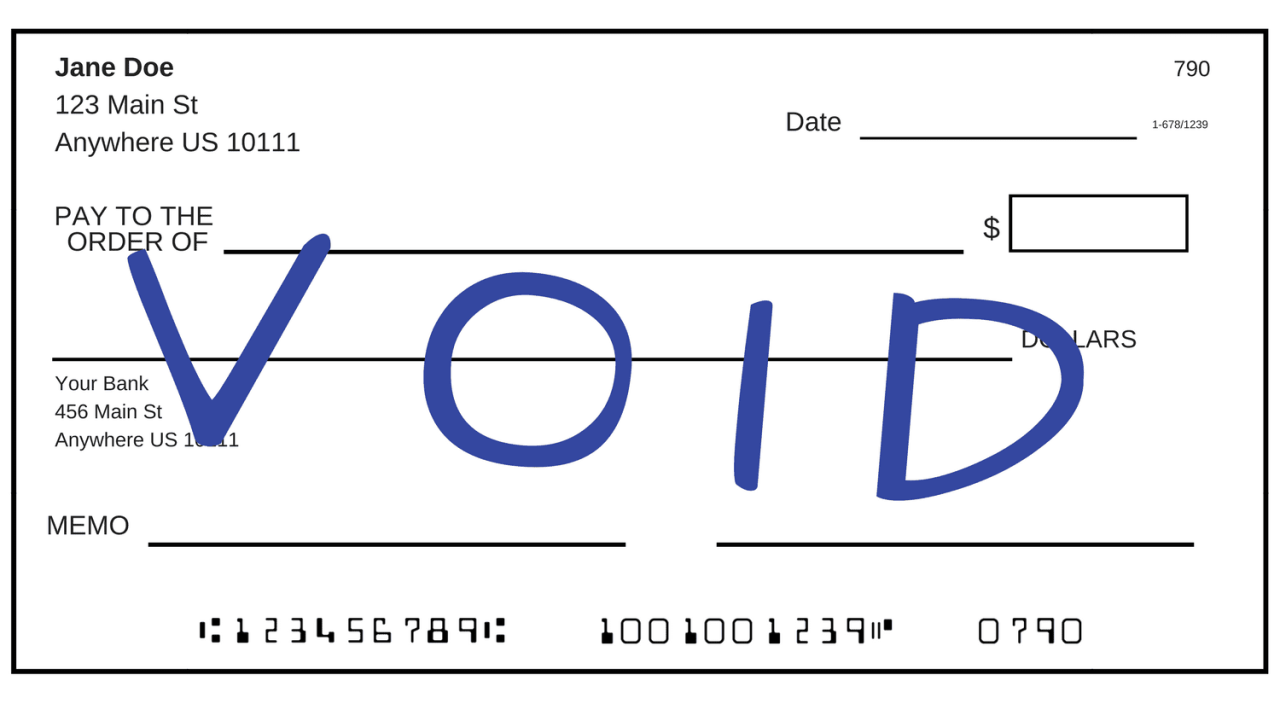

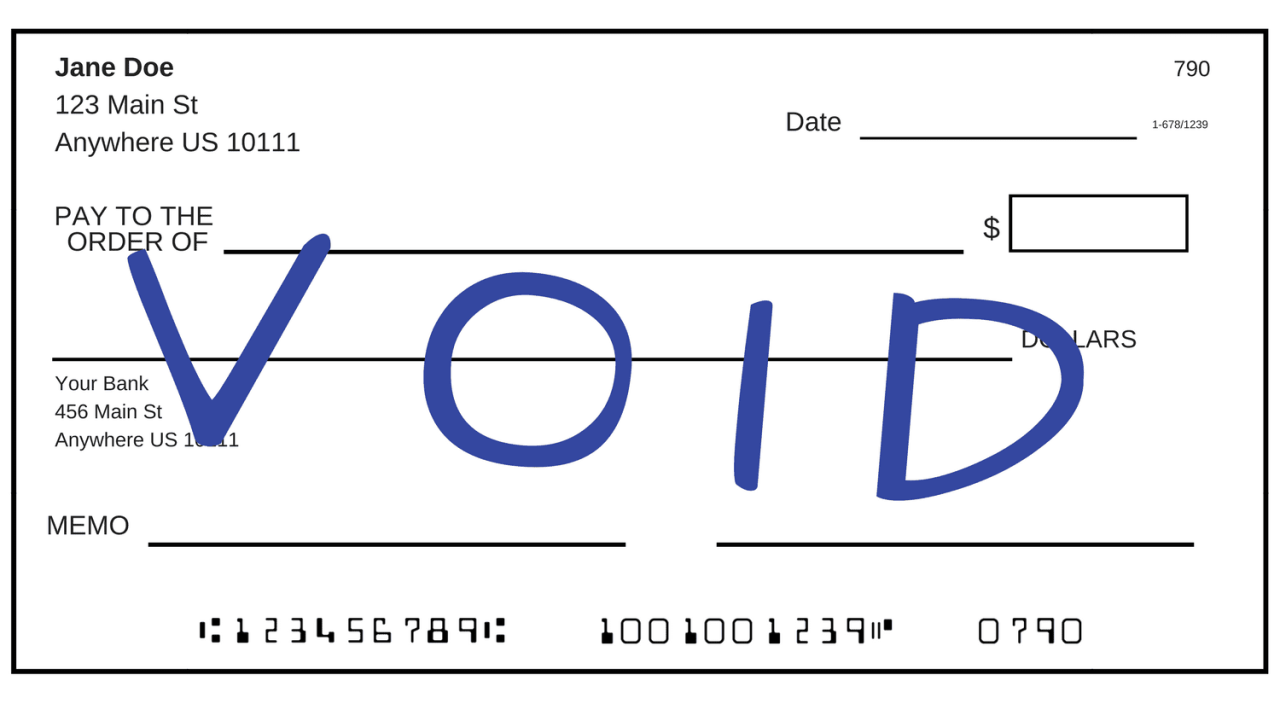

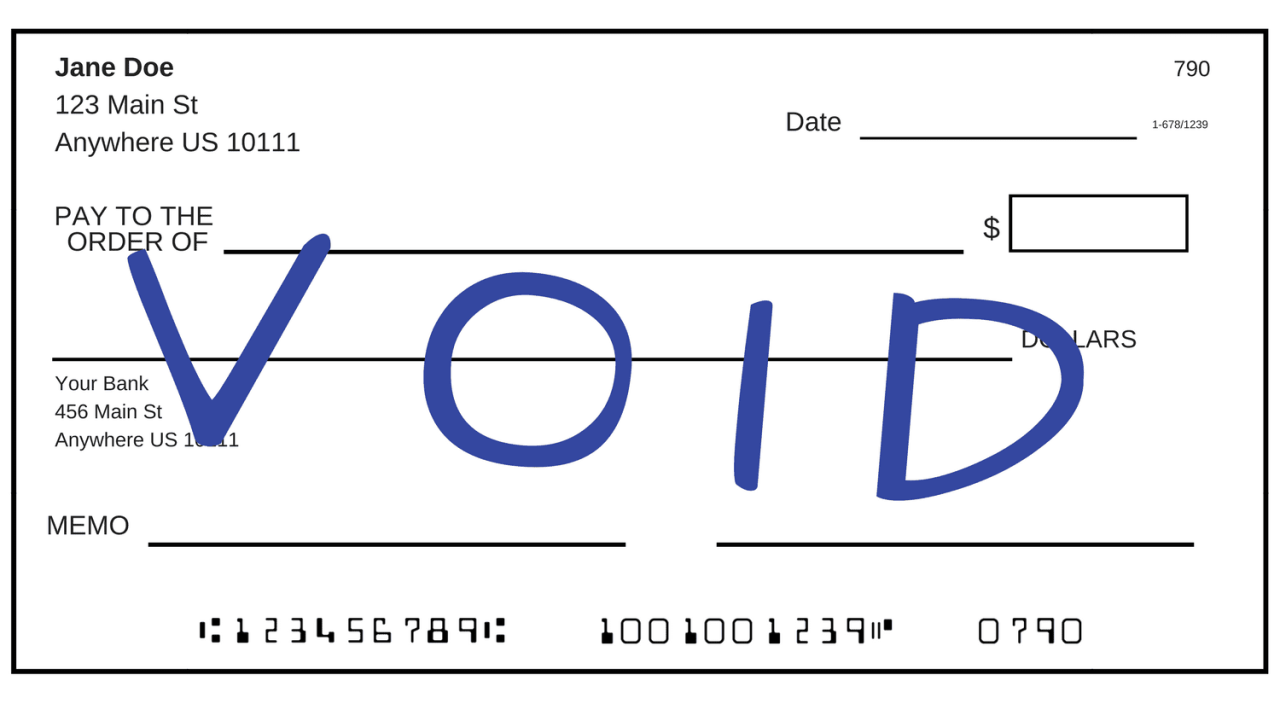

A void cheque is simply a regular cheque with the word “VOID” written across it. By doing this, you’re making sure the cheque can’t be used for payments or withdrawals. However, even though it can’t be cashed, it still contains your important banking information—like your account number, branch number, and institution number.

A void cheque is simply a regular cheque with the word “VOID” written across it. By doing this, you’re making sure the cheque can’t be used for payments or withdrawals. However, even though it can’t be cashed, it still contains your important banking information—like your account number, branch number, and institution number.

When you give a void cheque to someone, such as your employer or a service provider, they can use the details on the cheque to set up electronic transactions. This is how direct deposits, pre-authorized debits, and automatic bill payments are typically arranged in Canada. So, while the cheque itself is “voided,” the information on it remains valuable for setting up payments to and from your account.

How to Void a Cheque in Canada

Voiding a cheque is a simple process. To void a cheque in Canada, follow these simple steps:

- Take a blank cheque from your chequebook.

- In large, clear letters, write “VOID” across the front of the cheque.

- Make sure not to cover important details like the account number, branch number, and institution number at the bottom of the cheque.

- Submit the voided cheque to your employer, service provider, or anyone else who needs your banking information for direct deposits or automatic payments.

If you don’t have physical cheques, here’s how you can get one through online banking:

- Log in to your online banking account.

- Look for the option to download a void cheque or pre-filled account information.

- Download and print the void cheque, or send it electronically if needed.

When and Why Do You Need a Void Cheque?

You’ll need a void cheque when setting up various electronic payments and transfers in Canada. It’s commonly requested by employers, service providers, or financial institutions for one main reason: to provide your banking details in a secure way without risking an actual payment being processed using the cheque.

You’ll need a void cheque when setting up various electronic payments and transfers in Canada. It’s commonly requested by employers, service providers, or financial institutions for one main reason: to provide your banking details in a secure way without risking an actual payment being processed using the cheque.

Here are a few situations where you might need to provide a void cheque:

- Setting up Direct Deposit: Employers often ask for a void cheque to deposit your pay directly into your bank account. This avoids delays or the need for physical paycheques.

- Automatic Bill Payments: Many utility companies or service providers (like your phone or internet provider) require a void cheque to set up pre-authorized debits. This lets them withdraw payments directly from your account on a recurring basis.

- Mortgage or Loan Payments: If you’re making regular payments toward a loan or mortgage, a void cheque allows the bank or lender to withdraw those payments automatically.

- Government Payments: For benefits like the Canada Child Benefit (CCB) or pension payments, a void cheque can be used to ensure the funds are deposited into your account directly.

In all of these cases, the void cheque makes it easy for the person or organization you’re dealing with to access your banking details safely and accurately. While the cheque itself can’t be used for transactions, the information on it is critical for setting up these types of automatic payments and deposits.

Void Cheque

A simple guide on how to void Cheque in Canada

How to Use a Void Cheque for Direct Deposit or Pre-Authorized Payments

Using a void cheque for direct deposit or pre-authorized payments is straightforward. The purpose is to provide your banking information to the person or company setting up the transaction. Here’s how you can use a void cheque in these situations:

Using a void cheque for direct deposit or pre-authorized payments is straightforward. The purpose is to provide your banking information to the person or company setting up the transaction. Here’s how you can use a void cheque in these situations:

For Direct Deposit:

- Get a void cheque: Write “VOID” across a blank cheque, or download a void cheque from your online banking if you don’t have paper cheques.

- Submit the cheque: Give the void cheque to your employer or organization requesting it. This allows them to input your banking details for automatic deposits.

- Confirm your details: Ensure that the information—your account number, institution number, and branch number—is accurate so your salary or other payments go directly into your account.

For Pre-Authorized Payments:

- Write “VOID” on the cheque: Just like with direct deposit, void a blank cheque by writing “VOID” across it.

- Provide the cheque to the service provider: Whether it’s a utility company, gym membership, or any recurring service, give them the void cheque to allow them to set up pre-authorized debits.

- Agree on payment terms: Make sure you’re aware of when and how often payments will be debited from your account.

Using a void cheque makes these processes simpler, as it eliminates the need for back-and-forth communication about your bank details. Once the cheque is submitted, the setup is typically handled automatically, saving you time and reducing the risk of manual errors.

Alternatives to a Void Cheque in Canada

If you don’t have access to a physical chequebook, there are still a few alternatives you can use in Canada to provide your banking information.

If you don’t have access to a physical chequebook, there are still a few alternatives you can use in Canada to provide your banking information.

Many people no longer use paper cheques, so banks and financial institutions have made it easier to set up direct deposits and automatic payments without needing a void cheque.

Here are some alternatives to a void cheque:

1. Direct Deposit Forms

Most Canadian banks offer direct deposit forms that include all the necessary banking details. These forms are available online through your bank’s website or mobile app. They contain your account number, branch number, and institution number, making them a perfect substitute for a void cheque.

2. Banking Information Summary

If your employer or service provider needs your banking details, you can often provide them with a printed or electronic summary from your online banking account. This summary includes the same details that a void cheque would have—your account, branch, and institution numbers.

3. Pre-Authorized Debit (PAD) Agreement Forms

Many companies will provide their own pre-authorized debit (PAD) forms, which ask for your banking information. In this case, you can manually enter your account details instead of submitting a void cheque. These forms work just as well for setting up automatic payments.

4. Bank Statements

In some cases, a recent bank statement may be accepted as proof of your account information. Although not as common, this method is sometimes used when other options aren’t available.

By using one of these alternatives, you can avoid the hassle of dealing with paper cheques while still securely providing your banking details. Whether it’s for setting up direct deposits or recurring bill payments, these digital options make the process quick and convenient.

What Is a Void Cheque and How Do You Use It in Canada? A Simple Guide

- If you’ve ever set up direct deposit, pre-authorized payments, or automated withdrawals in Canada, chances are you’ve been asked to provide a void cheque.

- But what exactly is a void cheque, and why is it so commonly requested by banks and employers?

- In this guide, we’ll walk you through everything you need to know about void cheques in Canada—what they are, how to use them, and the easiest ways to get one, even if you don’t have a physical chequebook.

Where to Find a Void Cheque If You Don’t Have Chequebooks

If you don’t use physical chequebooks, you can still get a void cheque easily. Most Canadian banks understand that fewer people are using paper cheques, so they offer convenient ways to obtain a void cheque online or through their mobile apps. Here’s how you can get one without needing a chequebook:

If you don’t use physical chequebooks, you can still get a void cheque easily. Most Canadian banks understand that fewer people are using paper cheques, so they offer convenient ways to obtain a void cheque online or through their mobile apps. Here’s how you can get one without needing a chequebook:

1. Online Banking

Many banks in Canada allow you to download a void cheque directly from their online banking platform. Here’s how:

- Log in to your bank’s website or mobile app.

- Navigate to the section where your account details are located.

- Look for the option that says something like “Download Void Cheque” or “Direct Deposit Information.”

- You can then save or print this digital void cheque to submit it electronically or in person.

2. Bank Mobile Apps

If you prefer using your bank’s mobile app, the process is similar:

- Open the app and log in.

- Search for the section related to your account or direct deposit settings.

- Choose the option to generate or download a void cheque.

- From there, you can save it as a PDF or take a screenshot to share via email or submit online.

3. Visit a Bank Branch

If you’re unable to access your banking details online, you can visit your bank’s branch and request a printed void cheque. The teller can generate one for you with all your account information and mark it as void. This option may take more time but is still a reliable method.

4. Call Customer Support

Another option is to call your bank’s customer support and ask them to email or mail a void cheque to you. While this isn’t as fast as downloading one online, it can be a good fallback if you don’t have easy access to digital banking.

These methods ensure that even if you don’t use paper chequebooks, you can still quickly get a void cheque for setting up direct deposits or pre-authorized payments.

FAQs About Void Cheques in Canada

1. Is it safe to give a void cheque?

Yes, providing a void cheque is generally safe. Since the cheque cannot be cashed or used for payments, it serves mainly as a way to share your banking information securely. However, it’s always a good idea to ensure that you trust the person or organization you are giving it to.

2. What details are included on a void cheque?

A void cheque contains important banking information such as your account number, branch number, and institution number. This information is necessary for setting up direct deposits and automatic payments.

3. Can I void a cheque myself?

Absolutely! You can void a cheque by writing “VOID” across a blank cheque. Just make sure not to obscure the banking details that are still needed for setting up electronic payments.

4. What if I don’t have a chequebook?

If you don’t have a chequebook, you can obtain a void cheque through your bank’s online banking platform or mobile app. Most banks allow you to download a digital version. Alternatively, you can request one at your bank branch or call customer support for assistance.

5. Can a void cheque be used for anything other than direct deposits?

While a void cheque is primarily used for direct deposits and pre-authorized payments, it can also be requested for setting up automatic withdrawals or other recurring financial transactions.

6. How do I know if my void cheque was accepted?

After submitting a void cheque for a direct deposit or automatic payment, you should receive confirmation from your employer or service provider. They may inform you when the payment process is set up and operational.

Void Cheque

A simple guide on how to void Cheque in Canada

Conclusion

Whether you need to set up direct deposits for your paycheck, automate bill payments, or facilitate transactions with service providers, a void cheque provides a secure way to share your banking information.

With the convenience of digital banking, obtaining a void cheque has never been easier—whether through your online banking portal, mobile app, or at your local bank branch. And if you ever have questions or concerns, don’t hesitate to reach out to your financial institution for assistance.

By mastering the use of void cheques, you can streamline your financial processes and enjoy the peace of mind that comes with knowing your transactions are set up correctly. Now that you’re equipped with the knowledge, you can confidently navigate your banking needs in Canada!